-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

When a production line is down because a PLC failed, every minute is lost capacity and increased risk to your power infrastructure. For plants full of UPS systems, inverters, and sensitive power electronics, a stalled line also means irregular loads, stressed backup power, and frustrated stakeholders asking one question: how fast can we get the right Omron PLC in here?

From a reliability advisorŌĆÖs perspective, ŌĆ£where to buyŌĆØ is not just a procurement question. It is a risk decision about authenticity, lead time, technical support, and longŌĆæterm maintainability. Using only the available research, this guide outlines practical, technically grounded options to source Omron PLCs quickly and safely for production environments.

Programmable logic controllers are rugged industrial computers that execute control logic in real time and coordinate the behavior of drives, contactors, inverters, and protection devices. Multiple independent reviews, such as those from Industrial Automation Co., Origin-IC, PLC Department, and PEKO Precision, all treat PLCs as the ŌĆ£brainsŌĆØ of modern automation.

Omron is consistently listed among the top global PLC brands. PLC Department notes that OmronŌĆÖs CJ1, CS1, and CP1 series support modular or compact designs, builtŌĆæin Ethernet, and even thousands of I/O points with integrated CXŌĆæOne software for programming and simulation. Origin-IC emphasizes the Sysmac platform (NJ and NX controllers plus Sysmac Studio software), which integrates logic, motion, robotics, HMI, vision, safety, and sensing in one environment. PEKO Precision describes Omron PLCs as durable, accurate, and deployed from entryŌĆælevel up to full production lines across series like NX, NJ, CX, CP, CJ1, and CS1.

These are not lab curiosities. Industrial Automation Co. highlights a real case where a small electronics manufacturer used Omron CP1E PLCs for robotic soldering and cut defect rates by about 18 percent, improving precision and quality. When that kind of controller fails on a live line, the real cost is not only the replacement hardware; it is the idle downstream equipment, unbalanced feeders, and potential stress on UPS and power protection gear that are trying to support abnormal operating conditions.

Because Omron PLCs are often standardized across multiple machines and panels, one missing CPU or expansion module can hold up commissioning or recovery across an entire area of the plant. That is why you need a clear, preŌĆæplanned strategy for where to buy, before something fails.

Before discussing channels, it helps to understand what you are actually buying. OmronŌĆÖs own automation systems material distinguishes between three classes of industrial controllers: PLCs, PACs, and MACs.

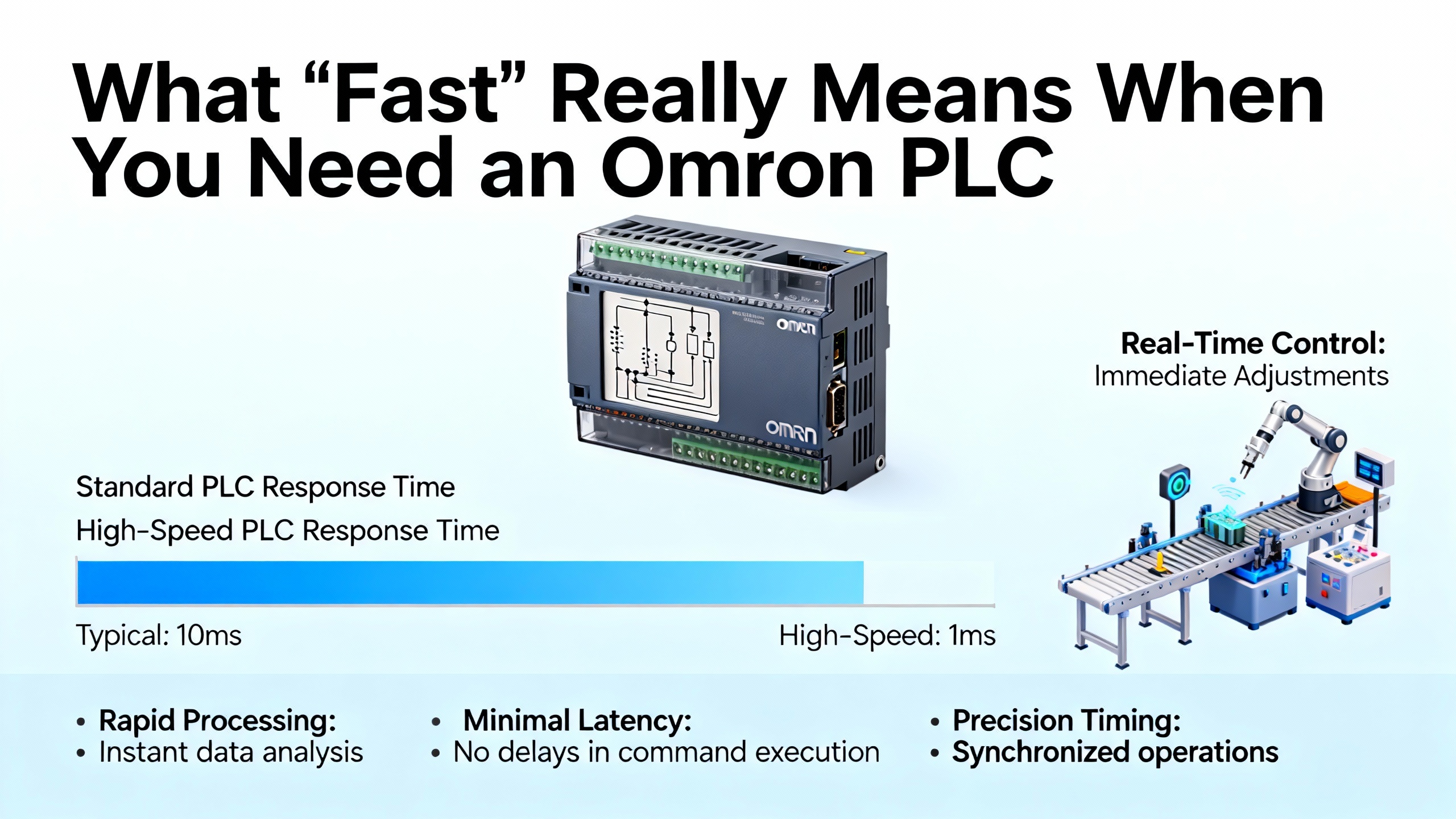

In the Omron taxonomy, a PLC is the simplest level and is aimed at straightforward logicŌĆæbased control. PACs, or programmable automation controllers, are designed as generalŌĆæpurpose controllers for broader process control where motion demands are modest. Machine automation controllers, or MACs, such as the NX and NJ families in the Sysmac line, are OmronŌĆÖs highŌĆæperformance controllers. MACs integrate motion, sequencing, networking, vision, safety, data handling, and robotics with a realŌĆætime scheduler that updates motion, network traffic, and application processes simultaneously rather than in sequence. That architecture allows tighter synchronization between drives, vision systems, and plantŌĆælevel data than classical PLCs or PACs.

On the PLC side, OmronŌĆÖs own product category pages highlight the CJ2H and CJ2M series as popular, widely adopted controllers. They are modular, with configurable I/O and communications, and are described as highŌĆæperformance CPUs with fast I/O response and ŌĆ£extreme scalability,ŌĆØ covering everything from small systems up to large architectures within one family. The vendor explicitly positions them as a single PLC platform that can serve most applications, which is exactly the kind of standardization many plants strive for.

Distributor catalogs reinforce the breadth of the portfolio. RSŌĆÖs Omron PLC listing shows compact CP1L and CP1LŌĆæEM CPUs, CP2E compact PLCs, and higherŌĆæend NX1 controllers with EtherCAT and EtherNet/IP. The CP1L and CP1LŌĆæEM units in that catalog typically provide a few dozen DC inputs and outputs in relay or transistor versions, with supply voltages around 20.4 to 26.4 V dc or wideŌĆærange ac in some models, and USB or Ethernet connectivity for programming and networking. CP2E models in the same listing appear as compact digital PLCs with around 18 to 24 inputs and 12 to 24 outputs, supply options of 24 V dc or 100 to 240 V ac, builtŌĆæin Ethernet, and often RSŌĆæ485 for fieldbus connections. At the very small end, the ZEN logic relay family provides simple relayŌĆætype control with limited I/O and basic analog capability for simple automation tasks. At the upper end, NX1 and related Sysmac controllers support industrial Ethernet networks and are labeled as ŌĆ£machine automation controllersŌĆØ suitable for more complex systems.

Several independent brand comparisons, including those from Origin-IC and PLC Department, confirm that OmronŌĆÖs range moves from compact, costŌĆæeffective PLCs up to integrated motion and vision platforms. That breadth is why you see Omron on packaging lines, in food and beverage plants, and in process skids, often alongside sensing, safety, and motion products from the same brand. FPE Automation, for example, positions Omron as a world leader in industrial automation components, emphasizing its sensors, switches, relays, safety interlocks, and drives that integrate with these controllers.

For procurement, this means a rushed purchase still has to respect platform differences. Accidentally ordering a CP2E instead of a CP1L, or a MACŌĆæclass controller instead of a PLC, will not help your recovery. Use the part numbering and series names from these catalog and vendor references as your anchor before you engage any channel.

Speed is not only about shipping. From a reliability standpoint, a ŌĆ£fastŌĆØ purchase is one that minimizes the time until a knownŌĆægood, correct, and supportable unit is configured and back in the panel. If you have to fight counterfeit concerns, missing accessories, or firmware mismatches, you have gained nothing.

This is where supplier quality metrics matter. A detailed analysis of Omron PLC suppliers by Accio, focused on global sourcing, suggests using hard performance numbers to qualify partners. They highlight onŌĆætime delivery rates above about 97 percent, typical response times under roughly four hours, and reorder rates in the 30 to 50 percent range as strong indicators that a supplier is reliable and keeps customers coming back. Some of the top performers they name, such as Changsha Zhinian Automation and Shenzhen Sandou Electronic, operate with review scores near 4.9 out of 5, onŌĆætime delivery rates near 99 to 100 percent, and reorder rates in the 32 to 44 percent range. Others like Guangzhou Eason Automation show high online revenue, well over $300,000, with onŌĆætime performance still around the highŌĆæninety percent level, while Teckon Electric in Shanghai stands out with a reorder rate of about 53 percent.

Those metrics, alongside ISO 9001 certification and official Omron partner status where it is available, reduce the risk that a ŌĆ£fastŌĆØ shipment becomes a longŌĆæterm reliability problem. For production lines feeding powerŌĆæhungry equipment and backed by UPS systems, that is essential, because poorŌĆæquality controls can cause intermittent faults and nuisance trips that are harder to diagnose than a clean failure.

From the available sources, four main channel types emerge for buying Omron PLCs quickly: authorized automation distributors and catalog houses, OmronŌĆÖs own product and sales network pages, global supplier hubs, and general marketplaces or secondary resellers.

For a plant in North America that needs an Omron PLC fast, an authorized automation distributor is usually the safest path to balance speed, authenticity, and support. Several of the research sources fall squarely into this category.

Industrial Automation Co. maintains a dedicated Omron PLC collection page aimed specifically at buyers who need Omron PLCs to keep industrial automation systems running. The page is described as a commercial landing and collection page rather than a technical guide, but it explicitly positions the company as a source for Omron PLCs alongside a broader set of Omron automation products. While that excerpt does not list models or prices, the combination of a dedicated category and filtering tools suggests a standard eŌĆæcommerce experience: identify the exact model, check availability, and order quickly.

RS, through its Omron PLC product listing, takes a similar approach but with more visible technical detail. The catalog data shows RS stock numbers, Omron part numbers, series names such as CP1LŌĆæEM, CP2E, ZEN, NX1, and NJ, I/O counts, output types, supply voltages, and interface options like Ethernet, USB, RSŌĆæ485, EtherCAT, and EtherNet/IP. That level of detail makes RS helpful when you need to confirm that a given CP2E or CP1L variant matches your panelŌĆÖs supply and I/O wiring before placing an urgent order. RS also hosts an Omron Automation brand section on its U.S. site, though the captured content indicates that the full page depends on JavaScript and adŌĆæblocker settings, so the raw snippet contains only a prompt to enable scripts. Even so, it confirms that Omron is a significant brand in RSŌĆÖs catalog.

Airline Hydraulics appears as an Omron authorized distributor for sensing components. Their Omron page focuses on sensors such as photoelectric, fiber, proximity, limit switches, encoders, and ultrasonic devices. It emphasizes that these sensing components are used to detect and measure operating conditions on production lines, and it recommends mapping each applicationŌĆödetection, positioning, tracking, inspectionŌĆöto the most appropriate sensor family. Airline Hydraulics also stresses that to get predictive and preventive benefits, those sensors should be integrated into monitoring or dataŌĆæcollection systems. While their featured content centers on sensing rather than PLCs, the combination of authorized status and deep device knowledge is valuable when your PLC replacement involves tiedŌĆæin sensors and safety circuits.

Cross Company (CrossCo) is another example. Its Omron programmable logic controller page, dated June 26, 2024, positions CrossCo as a solutions partner rather than only a parts supplier. The message is that CrossCo can supply automation equipment, including PLCŌĆærelated solutions, even outside its normal geographic territories, and that their teams work directly with customers to design applicationŌĆæ and locationŌĆæspecific automation systems. They explicitly encourage readers to contact Cross Automation to start scoping a solution. That orientation is particularly useful when the ŌĆ£fastŌĆØ requirement includes rewriting logic or redesigning a control panel after a failure or upgrade, not just shipping a box.

The main advantages of these authorized distributors and catalog houses are clear. They are closely aligned with Omron, often carry wide ranges of Omron hardware, and can provide at least basic technical support. Their catalogs make it easier to match part numbers correctly. Many operate in the same regions as your plant, which simplifies logistics compared with overseas sourcing. The tradeŌĆæoff is that headline pricing may be higher than the lowest global quotes; however, the risk reduction and support often justify that difference in production environments.

OmronŌĆÖs own sites are not primarily stores, but they are critical to buying correctly and, in some regions, to locating distributors.

The Omron Automation ŌĆ£Automation SystemsŌĆØ content explains the PLCŌĆōPACŌĆōMAC lineup and indicates when a PLC is appropriate (straightforward logic), when a PAC fits (general process control), and when a MAC is recommended (complex, multiŌĆæaxis, motionŌĆæcentric systems needing highŌĆæspeed coordination). The PLC page featuring the CJ2H and CJ2M series describes them as flexible, modular, and highly scalable controllers with faster I/O response and strong CPU performance. The narrative from Omron is that the CJ2 family can cover almost all typical applications, reducing the need to standardize across multiple PLC lines.

These pages, plus OmronŌĆÖs broader automation catalog descriptions, are best used to confirm series selection and understand where a given controller line sits in OmronŌĆÖs hierarchy. They provide the context you need to avoid underŌĆæ or overŌĆæspecifying a replacement.

On the commercial side, Omron Components maintains a ŌĆ£Global Sales Network ŌĆō Distributors in AmericasŌĆØ page. The captured text we have shows only a cookie and dataŌĆæuse notice and refers to a cookie policy, so the distributor details themselves are not visible in the snippet. However, the page title clearly indicates its purpose: listing distributor contacts in the Americas. Similarly, Omron AutomationŌĆÖs ŌĆ£Where to buyŌĆØ entry shows a cookie consent dialog, again without the underlying content, but the naming of the page indicates that Omron provides at least some guidance on purchasing channels.

In practice, that means OmronŌĆÖs own resources are starting points for identifying product families and, in some cases, pointing you toward authorized regional partners. You still typically complete the actual purchase through a distributor or integrator, but you do so with much higher confidence that you have the correct controller and a legitimate sales channel.

When you move from emergency replacements to strategic procurementŌĆösay, an OEM panelŌĆæshop standardizing on Omron PLCs across dozens of systemsŌĆöthe global supplier landscape becomes relevant. Here the Accio research on Omron PLC suppliers is particularly informative, although it is more focused on global sourcing than on emergency plant maintenance.

That analysis identifies China as the main global hub for Omron PLC supply, with coastal industrial clusters such as Guangdong (including Shenzhen and Guangzhou) hosting more than 70 percent of the major suppliers. Secondary regions include Fujian around Xiamen, Shanghai, and Hunan. These areas benefit from dense electronics ecosystems, strong logistics, and integrated R&D and testing capabilities. International buyers commonly encounter these suppliers via global B2B marketplaces and large trade shows, such as major export fairs, which enable direct engagement with factories.

Accio stresses that buyers should prioritize ISO 9001 certification and official Omron partner status where it is available in order to reduce the risk of counterfeit or nonŌĆæcompliant PLC hardware. They recommend using performance benchmarks like onŌĆætime delivery above about 97 percent, response times under four hours, and reorder rates in the 30 to 50 percent range to distinguish suppliers that reliably execute on promises. They also describe riskŌĆæmitigation practices such as checking ŌĆ£verified supplierŌĆØ designations on platforms, reviewing thirdŌĆæparty inspection or audit reports from firms like SGS, testing hardware samples against IEC 61131 requirements, and scrutinizing warranty terms and software integration support.

The case studies Accio cites are concrete. Suppliers such as Changsha Zhinian Automation and Shenzhen Sandou Electronic combine very high review scores, nearŌĆæperfect onŌĆætime delivery close to 99 to 100 percent, and reorder rates in the lowŌĆætoŌĆæmid forties. Guangzhou Eason Automation stands out with high online revenue above $300,000 while maintaining onŌĆætime delivery around 97 percent. Teckon Electric in Shanghai shows an exceptional reorder rate around 53 percent, although Accio notes that this supplier lacks a ŌĆ£verified supplierŌĆØ badge on the platform they examined, which means a buyer should perform extra due diligence. Emerging suppliers like Shantou Xinshide Automation and Shenzhen Newai Technology offer extremely fast quoted response times, sometimes on the order of an hour, and perfect onŌĆætime delivery in the sample data, making them interesting for urgent or smaller orders despite more modest revenue histories. One supplier, Shenzhen Qida Electronic, even discloses detailed facility data, including a factory area of about 970 square meters, which translates to roughly 10,400 square feet.

Accio also offers concrete commercial data. Typical minimum order quantities for customized Omron PLC configurations, in their sample, fall in the 50 to 100 unit range. Paid samples often cost roughly $50 to $200, with production cycles around 7 to 15 days. Large suppliers in these hubs commonly support worldwide shipping under standard terms such as delivered duty paid or ex works and maintain logistics partnerships into Europe and North America.

From a reliability advisorŌĆÖs perspective, this channel is attractive for planned, highŌĆævolume procurements and for building a strategic buffer stock of Omron PLCs, rather than for immediate, sameŌĆæday recovery. The distance and minimum order quantities mean it is best used when you can forecast demand and when the business case for lower perŌĆæunit pricing justifies the qualification effort. Used correctly, these suppliers can give you costŌĆæeffective, consistent access to Omron PLCs. Used casually, without verification, they can introduce serious risks, especially for safetyŌĆærelated control of power systems.

Another category that appears in the research is general online marketplaces such as AmazonŌĆætype retail platforms and auction sites. These are visible in two examples.

An Amazon product listing for an Omron programmable controller, model CP1WŌĆæ40EDR, is present in the research. The captured segment focuses on a ŌĆ£found a lower priceŌĆØ feature, where Amazon invites customers to report cheaper offers from other retailers, either online or in physical stores. The form collects details like where the price was seen and the date (in month and day format), and Amazon explains that it uses this information to keep its own pricing competitive. The text in this fragment is in simplified Chinese and is clearly about price reporting rather than technical specifications or industrial support.

An eBay listing for an Omron CS1WŌĆæBIO53 PLC base unit is also present. That excerpt is mostly about how eBayŌĆÖs promoted items work: the platform selects sponsored products to improve the shopping experience and generate advertising revenue. Relevance is determined using page views, user location, seller attributes, and broader marketplace activity. Users can influence how much their past behavior affects promoted items through AdChoice settings. There are no technical details about the Omron unit itself in this snippet.

These two examples show that general marketplaces and secondary resellers can be sources of Omron PLC hardware, especially legacy units that may be difficult to find through mainstream distributors. However, from a powerŌĆæsystem reliability viewpoint, they should be treated with caution for productionŌĆæcritical use. The research segments focus on pricing and advertising personalization, not on OEM authorization, traceability, or industrial support. For test benches, training rigs, or nonŌĆæcritical spares, such channels can be useful. For PLCs that supervise inverters, UPS transfer switches, or safety interlocks, they are usually not the first choice.

Different channels shine in different scenarios. The sources above allow at least a qualitative comparison, which is summarized here.

| Channel type | Examples from research | Strengths for fast Omron PLC supply | Main tradeŌĆæoffs |

|---|---|---|---|

| Authorized automation distributors and catalog houses | Industrial Automation Co. Omron PLC collection; RS Omron PLC listings; Airline Hydraulics Omron sensing portfolio; Cross Company Omron PLC solutions | Offer structured catalogs, modelŌĆælevel detail, and in many cases close alignment with Omron. Help match exact part numbers and, for CrossCo and similar, support application design. Well suited to urgent replacements in regions where they operate. | Hardware prices may be higher than the lowest global offers. Coverage depends on territory; availability of very old or niche models can be limited. |

| OmronŌĆÖs own product and sales network pages | Omron Automation PLC and automationŌĆæsystems pages; CJ2H/CJ2M product descriptions; Omron Components ŌĆ£Global Sales Network ŌĆō Distributors in AmericasŌĆØ | Provide authoritative information on controller families and, through sales network pages, indicate official distributor structures. Ideal for confirming you are buying the right series and working with a legitimate channel. | Not primary eŌĆæcommerce sites. Actual ordering still goes through distributors or integrators, and some captured content is limited to cookie notices, so you may need to navigate further to find local contacts. |

| Global supplier hubs for Omron PLCs | Supplier landscape analyzed by Accio, including companies such as Changsha Zhinian Automation, Shenzhen Sandou Electronic, Guangzhou Eason Automation, Teckon Electric, Shantou Xinshide Automation, Shenzhen Newai Technology, and Shenzhen Qida Electronic | Offer bulk procurement, competitive pricing, and strong logistics. The best suppliers show very high onŌĆætime delivery, fast response times, and strong reorder rates. Suitable for strategic stocking and large projects where you can plan lead times. | Often focus on higher minimum order quantities, such as 50 to 100 customized units. Qualification takes effort, including checking quality certifications, onŌĆætime metrics, and sample testing. Less suited to sameŌĆæday or nextŌĆæday emergency replacements from a single plant. |

| General marketplaces and secondary resellers | Amazon listing for Omron CP1WŌĆæ40EDR; eBay listing for Omron CS1WŌĆæBIO53 base unit | Useful for finding specific or legacy Omron parts and for opportunistic price advantages. Easy to search, and familiar purchasing workflows for many organizations. | Research excerpts emphasize price reporting and advertising algorithms, not industrial traceability or OEM authorization. Higher risk of inconsistent quality and weaker technical support, so generally less appropriate for safetyŌĆæcritical or powerŌĆæcritical applications. |

In practice, most production facilities benefit from a hybrid strategy. Authorized distributors and catalog houses handle the majority of urgent and standard purchases; OmronŌĆÖs own documentation anchors part selection and channel validation; vetted global suppliers support planned, highŌĆævolume procurement; and marketplaces remain a last resort for special cases.

Thinking like a reliability engineer, the right buying channel depends on the operational scenario more than on pure price.

For a lineŌĆædown emergency on a common Omron PLC, your first call is typically to an authorized automation distributor or integrator who already understands your installed base. Industrial Automation Co. and RS are geared toward quickly supplying Omron PLCs and related products through their online collections and detailed catalogs. Airline Hydraulics and CrossCo bring additional value because they can help you reason about the sensing and system context. CrossCo, in particular, emphasizes that it can work with customers even outside its normal territories to develop applicationŌĆæspecific solutions, which matters if the failure is tied to a design issue, not just a dead CPU.

OmronŌĆÖs own automation systems and PLC product pages play a supporting role in this scenario. You use them to doubleŌĆæcheck that the CJ2H, CJ2M, CP1L, CP2E, or NX controller you are ordering is truly equivalent to the failed unit, and that you are not downgrading from a MACŌĆæclass controller to a PLC by mistake. When a PLC is orchestrating power converters, static transfer switches, or coordinated drives that affect your UPS and power protection scheme, design equivalence is as important as shipping speed.

For a planned upgrade or expansion, you have more room to optimize cost and standardization. This is where the global supplier hub model described by Accio becomes attractive. With forecasted demand and a little time, you can qualify suppliers based on ISO 9001 status, Omron authorization, onŌĆætime performance, and responsiveness. You can order samples, test them in controlled conditions, and gradually move toward larger orders in the 50 to 100 unit range that those suppliers commonly support. If your OEM or panelŌĆæbuild operation is rolling out the same Omron CJ, CS, or CP series across multiple cabinets, the savings from a wellŌĆæchosen global supplier can be significant without sacrificing quality, provided you follow the riskŌĆæmitigation practices that Accio outlines, such as thirdŌĆæparty inspections and shipmentŌĆæhistory checks.

For training systems, lab rigs, or very old legacy equipment, general marketplaces can still be valuable. The Amazon and eBay examples show that Omron PLC hardware appears there, including specific part numbers like CP1WŌĆæ40EDR and CS1WŌĆæBIO53. When the consequence of failure is lowŌĆöfor example, a test panel not connected to live production or critical powerŌĆöyou may accept the uncertainty of that channel to get a lowŌĆæcost unit for experimentation. For any equipment that touches live production, especially where PLCs interact with UPS, inverters, or protection relays, the conservative choice is to stay with channels that are either directly tied to Omron or subject to the kind of quantitative performance scrutiny the Accio research recommends.

The Accio analysis of Omron PLC suppliers suggests several objective checks that can be applied quickly. First, look for ISO 9001 certification and any indication that the supplier is an official Omron partner; these two together greatly reduce the chance of counterfeit or nonŌĆæcompliant hardware. Second, ask for data on onŌĆætime delivery rates and response times. Suppliers highlighted in the research that consistently delivered on time more than 97 percent of the time and responded within about four hours were also the ones with strong reorder rates in the 30 to 50 percent band. Third, request recent thirdŌĆæparty inspection or audit reports from organizations such as SGS, and if you are sourcing large volumes, consider testing sample units against IEC 61131 requirements in your own environment. Finally, review warranty terms and the availability of software integration support; serious Omron suppliers understand the importance of configuration and programming assistance, not just shipping boxes.

The CrossCo Omron PLC page makes a clear case for solutionŌĆæoriented partners: they are most valuable when the requirement is not just a oneŌĆæforŌĆæone replacement but a change in the control architecture. If you are migrating from a basic PLC to a motionŌĆæcentric MAC, integrating Omron PLCs with a new sensor suite, or modernizing a system that handles both power control and safety, a partner that designs and integrates automation solutions can shorten the engineering path significantly. They can help you interpret OmronŌĆÖs controller tiers, choose between CJ2, CP, and Sysmac options, and design the interaction with drives, sensors, and UPS interfaces. Catalog distributors, by contrast, are typically optimized for quick fulfillment once the design is known. In practice, many organizations use both: a solutions partner to design and validate, and one or more distributors to provide dayŌĆætoŌĆæday hardware replenishment.

The answer depends less on geography and more on how rigorously you apply the qualification practices that Accio documents. Their research shows that Chinese Omron PLC suppliers in hubs such as Guangdong, Shanghai, Fujian, and Hunan can achieve excellent onŌĆætime delivery and customer satisfaction metrics and can support worldwide shipping with reasonable lead times. They also show that these suppliers often operate with meaningful minimum order quantities and that performance varies widely between companies. For safetyŌĆæ or powerŌĆæcritical PLCs, global hubs can absolutely be part of your strategy, but only after you have validated their credentials, inspected sample hardware, and understood their warranty, support, and changeŌĆæmanagement processes. For oneŌĆæoff emergency replacements, especially when you cannot wait for sample testing or audits, local authorized distributors remain the more conservative choice.

For Omron PLCs that sit at the center of your production and powerŌĆæcontrol architecture, the fastest purchase is the one that gets the right, authentic controller back into service with minimal risk. The research points toward a layered strategy: use OmronŌĆÖs own documentation to define what you need, lean on authorized distributors and solutions partners for urgent and complex work, deliberately cultivate highŌĆæperforming global suppliers for planned volume, and keep general marketplaces in a clearly defined, lowŌĆærisk role. If you make those decisions now, before the next controller fails, your PLC sourcing will support your uptime and powerŌĆæsystem reliability instead of becoming another vulnerability.

Leave Your Comment