-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

Integrated control in a refinery is no longer just a question of DCS screens and control loops. It is the convergence of process automation, robotics, AI, business workflow automation, and a resilient electrical backbone that keeps all of it powered and trustworthy. As a power system specialist working with refinery owners and EPC teams, I have seen that you only unlock the full benefit of modern automation when the control architecture and the power architecture are designed as one system.

This article walks through how that integration works in practice, what the research and case studies are telling us, and how to navigate the trade-offs with reliability, safety, and lifecycle cost in mind.

Refineries are under simultaneous economic, regulatory, and workforce pressure. Margins are squeezed by volatile feedstocks and tight product spreads, while aging assets and stricter environmental rules make even small gains in reliability, yield, and energy intensity economically significant. Several sources point in the same direction: digital transformation is no longer optional. It is the only way many refineries stay competitive.

BrightPath Associates emphasizes that refinery operations management now spans complex logistics, supply chains, and compliance, and that digital tools have shifted from buzzword status to a hard requirement to stay responsive and sustainable. At the same time, the labor side is tight. Ashling cites Bureau of Labor Statistics data showing field unemployment around 1.8% in midŌĆæ2023, with companies like ExxonMobil raising compensation by about 9% in a single year to retain talent. This makes automation a practical necessity just to keep plants staffed and productive.

The operational risk is also clear. EnergiesMedia reports that mid-size refineries can lose $20ŌĆō50 million per year to reliability problems, and that a large plant may lose over $1 million per day when a major unit like an FCC unexpectedly trips. Unplanned maintenance typically costs about half again as much as planned work, and each hour of downtime can cost roughly $100,000ŌĆō1,000,000. In that context, investing in automation that avoids failures and shortens outages is not a luxury project; it is a direct response to very expensive pain.

Overlaying all of this is regulatory and social pressure for lower emissions and better environmental stewardship. The International Energy Agency estimates that petrochemical energy use could be reduced by around 13% by broad deployment of best available technologies, with automation as a key contributor. Smart technology studies summarized by Kissflow and others report that digital solutions can cut perŌĆæbarrel operating costs by up to 25%, reinforcing that integrated automation is central to the ŌĆ£smart refineryŌĆØ of the 2020s.

However, there is a catch. Ashling notes that roughly 70% of digital transformation initiatives in oil and gas never make it beyond the pilot stage. In my experience, one of the reasons is that projects tackle isolated islands of automation without designing the full stack: from sensors up through process control, analytics, business workflows, and the power and network infrastructure that keep it all alive. Integrated control for refining is about closing that stack.

Integrated control is often described as a hierarchy of layers, but in practice it is a tightly coupled ecosystem. At the field level we have sensors, actuators, PLCs, and DCS controllers running the real-time process. Above that, SCADA, HMIs, and historian systems supervise operations. On top of that sit advanced control, optimization, AI, and digital twins tuning the plant to meet economic and environmental targets. Around it, robotic systems, drones, and automated sampling equipment interact with the physical plant. Parallel to all this, robotic process automation and lowŌĆæcode platforms orchestrate business workflows, quality processes, and compliance documentation. And underpinning everything is a power system with UPS, inverters, and protection that prevent electrical disturbances from turning sophisticated automation into a single point of failure.

Control Engineering describes how AI, digital twins, and robotics are already reshaping process automation, pushing plants from traditional automation toward autonomy. YokogawaŌĆÖs work on robot management and collaborative information servers shows how robots, DCS, and IT systems can share data in real time. At the same time, research from academia and industry on PLC and SCADA architectures demonstrates that robust real-time control remains the foundation. Integrated control is about making these pieces work together rather than treating them as separate projects.

The core of refinery automation remains the process control layer. A widely cited refinery automation study on Academia.edu describes an architecture built around PLCs and SCADA that spans seven main units: drilling, separation, production, refining, storage, and a central control unit. Each area is instrumented with sensors and actuators connected to programmable logic controllers, which handle local logic, sequencing, timing, and analog control. On top of that, SCADA provides supervisory control, trending, and alarms, giving operators a graphical view of each unit and the refinery as a whole.

Traditional distributed control systems perform a similar role in many plants. The key automation benefits are consistent across PLC/DCS/SCADA technologies. JHFoster notes that intelligent sensors and automated monitoring integrated with IoT and analytics continuously measure temperature, pressure, and flow rate, enabling real-time adjustments that maximize yield, product quality, and overall equipment effectiveness. Automation reduces human error, allows 24/7 operation without fatigue, and frees skilled staff from routine manual interventions.

The PLC/SCADA study frames automation as safer, sturdier, more economical, and nearly maintenance-free when compared with manual control. Automated interlocks and remote operation keep people out of high-risk areas, while modular PLC and SCADA design with redundancy and robust communications improves fault tolerance. In the refineries I have worked with, robust PLC and DCS power supplies backed by UPS are considered non-negotiable; any reset or brownout in these controllers can ripple instantly into lost throughput or, in the worst case, a safety incident.

The next layer is advanced automation: AI, machine learning, optimization, and digital twins that sit on top of the control system to predict problems and optimize operations. BSO Services defines AI-enabled process automation as traditional DCS/PLCs/SCADA enhanced with real-time data ingestion, predictive and prescriptive analytics, and semi- or fully autonomous control loops. These tools can anticipate failures and recommend or implement corrective action before people notice a trend on a trend display.

Practical refinery use cases are now well documented. BSO describes a medium-sized refinery pilot that instrumented a distillation unit and utilities, deployed machine learning models to predict heat exchanger fouling, and optimized steam usage. The result was about a 5% reduction in steam consumption and a 3% increase in unit throughput, which was then scaled to other units and used as a basis for a utilities digital twin. EnergiesMedia reports other deployments where predictive asset management cut unplanned downtime by 20ŌĆō30%, improved distillation-tank variability by roughly half, and delivered millions of dollars per year in savings through throughput and energy gains.

Digital twins act as high-fidelity virtual replicas of assets and processes. Control Engineering explains that they estimate otherwise unmeasurable variables, predict future behavior, and provide a testbed for optimization. Engineers can test control strategies and process changes offline, which cuts downtime and engineering cost and is a critical enabler for more autonomous operation. As QFoilŌĆÖs analysis of refining trends highlights, process optimization via advanced chemical engineering and automation can raise distillation yields by up to 15%, and digital twins can reduce time to market for new products by about a quarter.

From a power systems perspective, these analytics-heavy layers drive a different kind of reliability requirement. They rely on dense data collection from PLCs, smart instruments, and edge devices, as well as on compute platforms and storage that typically reside in control rooms, data centers, or industrial PCs at the edge. Each of those nodes needs clean, well-protected power; otherwise, your predictive models will go offline just when you need them most.

Automation is no longer just about valves and drives. Robotics is moving into refineries to handle inspection, material handling, and even some maintenance tasks. 3Laws Robotics describes deployments where robots operate in close proximity to humans, guided by safety software like 3Laws Supervisor that uses real-time guardrails and intelligent decision-making. Their case study reports about a 40% efficiency gain from robotic automation with a payback period of around six months, a compelling return for large sites.

The same source emphasizes that refinery environments are dynamic and high-risk, so safety systems must be proactive. Their approach uses control barrier functions to enforce safe behavior across diverse platforms, from mobile robots to drones and manipulators. They integrate with robotics middleware such as ROS and ROS 2 and pursue safety certifications like ISO 3691-4 and ISO 26262, aiming to provide a certified safety layer that unlocks the full capability of dynamic robotic automation. In environmental terms, the International Energy AgencyŌĆÖs estimate of roughly 13% potential energy savings in petrochemicals through best available technologies connects directly to this kind of automation; robots can execute inspection, cleaning, and adjustment tasks with a consistency that supports tighter energy and emissions control.

Control Engineering illustrates the next step by showing how robotics can be integrated directly with the DCS via platforms like a Robot Management Core, which subscribes to alarms from the control system and dispatches robots for site inspections. This closes the loop between process deviations, physical inspection, and updated control actions. In practice, that only works if robot charging systems, wireless infrastructure, and edge controllers have stable power and protection; otherwise, the robots become yet another brittle dependency.

Integrated control does not stop at the unitŌĆÖs edge. Back-office and quality processes are increasingly automated to remove human error, speed up decision-making, and create audit-ready records. Ashling defines robotic process automation as software robots that execute repetitive, rules-based tasks such as purchase order generation, billing validation, contract renewal alerts, compliance checks, and IoT data consolidation. Intelligent process automation combines RPA with AI to tackle more complex tasks like predictive maintenance planning and leak or anomaly detection.

Industry-wide, intelligent automation is expected to deliver between $237 billion and $813 billion in cost savings, primarily by reducing production costs and shortening timelines. On the ground, tools like COPASŌĆÖs centralized entry systems show what this looks like: a single batch entry of material transfers can automatically propagate into accounting, production, reporting, and forecasting systems, eliminating dozens of manual entries and greatly easing auditing.

On the quality side, Kissflow describes how lowŌĆæcode platforms turn paper-based inspection forms into mobile workflows with real-time validation, automatic flagging of out-of-range values, and rule-based routing of non-conformances. AI models analyze inspection and process data to detect anomalies and predict quality issues before they reach the tank farm. The article notes that about 77% of organizations are investing in AI for quality assurance, and that digital solutions in refining can cut operating costs by up to 25% per barrel according to McKinsey. LowŌĆæcode solutions provide agility for quality teams while allowing IT to enforce security, version control, and change management.

FlowForma and other workflow providers highlight that human error accounts for a large share of failures in standard oil and gas tasks. Digitizing and standardizing workflows, combined with validation and audit trails, reduces those errors and gives management real-time visibility into where delays or compliance risks are arising. For integrated control, this means that the same alarms and events that trigger control responses can also launch digital workflows for investigation, approvals, and reporting.

Once again, none of these benefits are realized if the underlying servers, network devices, and operator clients are vulnerable to power disturbances. In my own projects, I have seen seemingly ŌĆ£back-officeŌĆØ systems like batch reporting databases bring operations to a halt when they go down, because production, compliance, and commercial teams lose a common view of the truth.

As you stack up sensors, controllers, robots, and servers, you are also increasing your dependency on reliable electrical power. The business case for process automation is often quantified in terms of fewer trips, better yields, and lower energy intensity. Yet one of the most common causes of control and data system instability in refineries I visit is not a software bug, but a voltage sag, switching transient, or poorly coordinated transfer between utility and onŌĆæsite generators.

Energy costs are one of the largest operating cost drivers in refining, as the Penn State market drivers overview notes. EnergiesMedia reports that processing costs run around $11.75ŌĆō20.00 per barrel and that energy accounts for more than half of non-crude operating expenses. When you lose the automation that keeps heaters, compressors, and utilities optimized, those costs rise quickly. Add the downtime cost figures mentioned earlier, and it becomes clear that protecting control and automation power is integral to the economic case for automation itself, not a separate electrical ŌĆ£nice to have.ŌĆØ

In practice, I treat the automation and control ecosystem as a set of critical load tiers. At the highest tier are safety instrumented systems, basic process control for critical units, and emergency shutdown systems. Then come supervisory and historian systems, robotics infrastructure, and communications. Finally, business process automation and analytics platforms form a third tier. Each tier merits appropriate power conditioning and backup time, often with layered UPS systems and selective generator-backed feeds.

Small power events can have outsized impact on integrated control. A momentary voltage sag when a large motor starts can reset PLCs that are not properly protected, leading to process upsets. Harmonics from variable-speed drives can disturb sensitive instrumentation or UPS rectifiers if filtering is not designed correctly. Switching surges from capacitor banks or feeder transfers can glitch Ethernet switches or industrial PCs. When those devices are carrying IIoT data, AI model outputs, or RPA transaction logs, a brief disturbance can corrupt data, stall optimization, or trigger spurious alarms.

I have walked into control rooms right after a poorly coordinated transfer from utility to generator where the lights stayed on but multiple HMIs rebooted, the historian stopped logging, and some controllers dropped communication. From an operatorŌĆÖs point of view, it looked like a control-system failure. From a reliability perspective, it was an avoidable power-quality issue. As refineries adopt more cloud gateways, edge compute, and wireless access points to support robotics and sensors, the number of vulnerable endpoints grows quickly.

A robust integrated-control design pairs automation architecture with a layered power architecture. At a high level, you want conditioned, UPS-backed buses feeding critical automation loads; selective use of static transfer switches for dual-corded equipment; surge and transient protection coordinated with switchgear; and clear separation between noisy power consumers and sensitive electronics.

A helpful way to visualize this is to map automation layers against their power and reliability needs. The following table is a simplified example.

| Automation layer | Example technologies | Impact if power fails |

|---|---|---|

| Safety and basic process control | SIS, DCS controllers, critical PLCs | Potential trips, safety risk, immediate downtime |

| Supervisory and operations support | SCADA, HMIs, historians, engineering stations | Operators ŌĆ£go blind,ŌĆØ slower response, manual work |

| Field and edge intelligence | Smart sensors, edge gateways, robots, drones | Loss of data, degraded optimization and inspections |

| Business and quality workflows | RPA/IPA platforms, QC low-code apps, ERP links | Delayed decisions, compliance and billing impacts |

| Analytics, AI, and digital twins | ML servers, optimization engines, simulation | Reversion to manual or basic control, lost savings |

Each row in that table should be matched with specific power-protection measures, from double-conversion UPS and redundant feeds at the top through carefully sized UPS or power conditioners at the edge. When you perform a refinery-wide automation upgrade, a power system study that includes short-circuit levels, coordination, and harmonic analysis for the new loads should be part of the scope, not an afterthought. Given that EnergiesMedia cites hourly downtime costs up to $1 million in some cases, investing in power protection that prevents a handful of outages can justify itself quickly.

Bringing all these layers together can feel overwhelming, particularly when legacy systems and tight budgets are involved. The most successful refineries I have supported take a staged, business-driven approach that aligns automation, data, and power from the start.

Ashling recommends beginning with clear business objectives and measurable targets, whether they are reductions in energy intensity, downtime hours, or emissions, or improvements in yield and labor productivity. BSO echoes this, advising refiners to assess their current data and automation maturity and then launch focused pilot projects on specific units before scaling. Their distillation and utilities pilot is a textbook example: a clearly bounded scope, well-instrumented equipment, and direct linkage to steam and throughput savings.

Before launching a pilot, I encourage teams to ask three reliability questions. First, can the existing power system supply the new automation and compute loads without compromising protection margins or causing nuisance trips? Second, are the critical components of the pilotŌĆöcontrollers, servers, network gearŌĆöon clean, backed-up power with realistic autonomy? Third, do the operators and maintenance staff understand how the new automation will behave in abnormal electrical conditions, such as generator operation or partial bus outages? Addressing those questions early reduces surprises during commissioning.

Ashling and FlowForma both stress the value of process mining and workflow discovery before automating. Mapping how work actually flows through maintenance, quality, and operations groups helps you pick RPA and lowŌĆæcode use cases that matter and avoid automating broken processes. Establishing a Center of Excellence for automation governance, as recommended by Ashling, helps standardize tools, templates, and security practices across the refinery.

On the technology side, Control Engineering and QFoil suggest that pilot projects around advanced control, digital twins, and predictive maintenance for high-value units are particularly powerful. Equipment like heat exchangers, fired heaters, and compressors often combine high downtime impact with strong optimization potential. EnergiesMediaŌĆÖs data on outage costs reinforces this focus: eliminating recurring reliability issues can save tens of millions of dollars over a few years in some refineries.

Cybersecurity and data governance are essential as you connect more devices and systems. BSO highlights heightened cybersecurity and functional-safety risks as key implementation challenges, and TalentNeuron notes that many experts now rank cyberattacks among the top global risks. In practical terms, this means segmenting control networks, enforcing strict access controls on SCADA and lowŌĆæcode platforms, and planning for secure remote access and updates. From an electrical standpoint, it also means ensuring that security appliances and monitoring tools are on protected power; a cyber-incident detection system that drops offline in a power event is of limited use.

Workforce and culture often matter as much as technology. BrightPath points out that successful digital refineries rely on comprehensive training and a culture of continuous learning. FlowForma and EnergiPersonnel emphasize change management, upskilling, and user-friendly tools that field staff can access easily, even without constant computer access. I have seen adoption rates rise dramatically when teams use simple mechanisms like QR codes on equipment to launch digital processes and when workers see that automation removes drudgery rather than replacing their judgment.

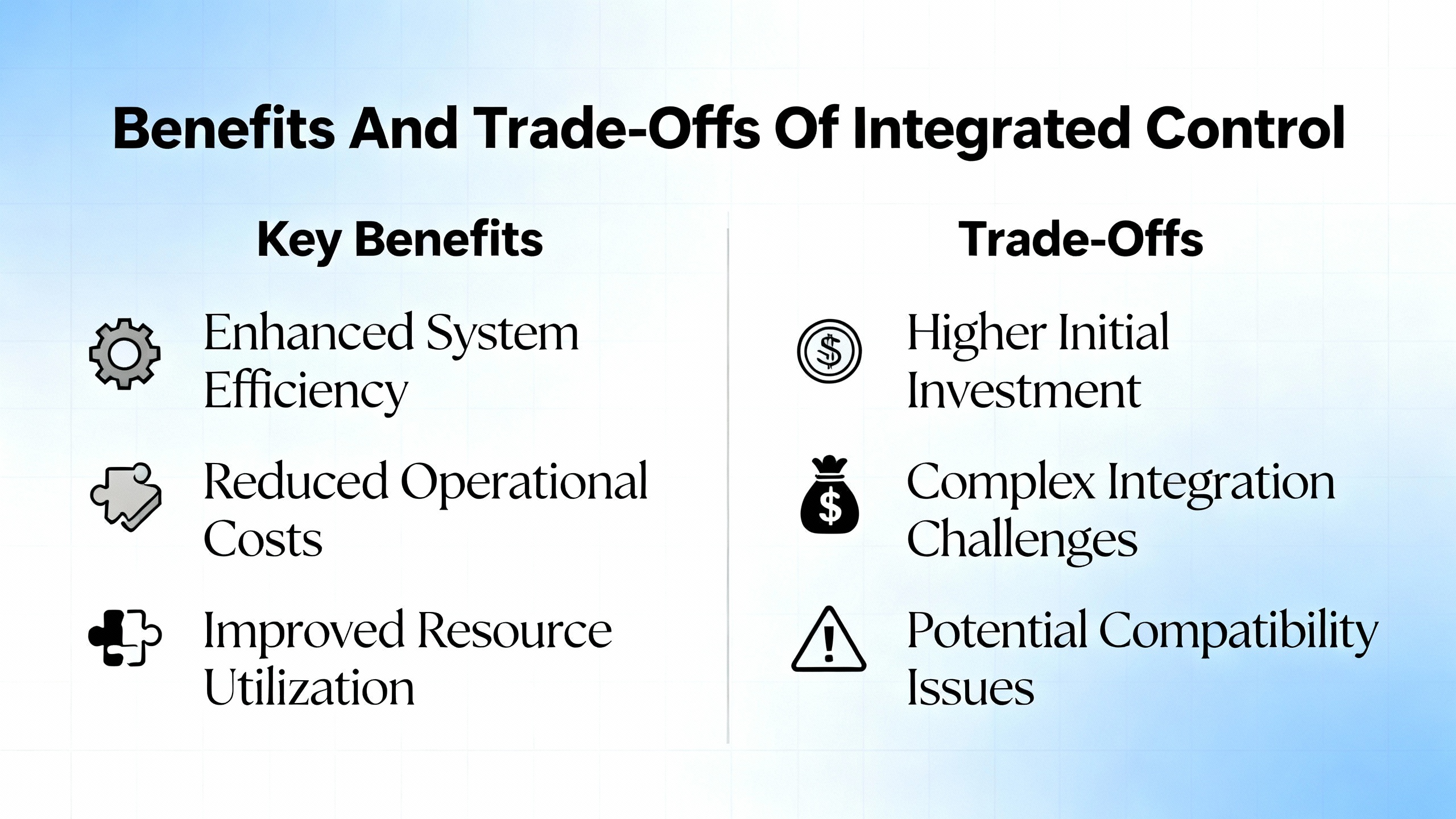

The upside of integrated control, when done correctly, is tangible. Across the sources, consistent benefits emerge. EnergiesMedia and Kissflow report that digital and automation solutions can cut operating costs per barrel by up to a quarter. BSO and EnergiesMedia case studies show measurable improvements in throughput and energy efficiency, while QFoil cites distillation yield improvements and meaningful reductions in unplanned downtime. JHFoster and the PLC/SCADA refinery study both underline improvements in safety, as automation removes personnel from hazardous environments and responds faster and more consistently to process upsets.

Automation also supports environmental and community goals. Automation and AI-based monitoring help detect leaks and abnormal emissions quickly, as described by BSO and Ashling, while automation-focused conference reports highlight automated shutdown systems that prevent spills and reduce contamination risk. These capabilities simplify regulatory compliance and support long-term sustainability strategies, which BrightPath and multiple trend analyses identify as central to future competitiveness.

However, there are real trade-offs and risks. High upfront investment remains a barrier, particularly for smaller operators, as noted by EnergyNow and several automation trend reports. Cybersecurity risk increases as more systems are interconnected. Aging infrastructure and legacy IT, highlighted by Ashling and BrightPath, make integration challenging. Cultural resistance and skills gaps can slow or derail projects. From a power-system viewpoint, concentrating critical control and data functions on a small number of electrical buses can create new single points of failure if you do not design redundancy and protection carefully.

Open process automation initiatives offer one way to reduce some of these risks. Control Engineering describes the Open Process Automation Standard, which aims to make automation systems more interoperable and modular, reducing vendor lock-in and lifetime cost. Pairing open, standards-based automation architectures with carefully designed electrical infrastructure gives refiners more flexibility to evolve over time without wholesale rip-and-replace projects.

In my experience, the most successful integrated-control programs are explicit about these trade-offs. They are honest about capital requirements and change management challenges, but they also quantify the cost of doing nothing in terms of reliability, energy use, and lost competitiveness.

Q: Does integrated control mean committing to a single automation vendor everywhere in the refinery? A: Not necessarily. With careful architecture and use of open standards like those promoted in open process automation, refineries can integrate PLC, DCS, SCADA, robotics, and lowŌĆæcode platforms from multiple vendors. The key is to define clear interfaces and data models and to ensure that the underlying power and network infrastructure can reliably support mixed environments.

Q: Where is the best place for a refinery to start with advanced automation and AI? A: The most effective starting points tend to be units or utilities with clear, high-impact pain points such as frequent unplanned downtime, high energy intensity, or chronic fouling. The distillation and utilities pilot described by BSO is a good example. Start with a well-bounded pilot backed by strong instrumentation, solid power and network foundations, and clear success metrics, then scale what works.

Q: How do we justify investment in UPS and power protection for control and automation systems? A: The outage cost numbers reported by EnergiesMedia and others provide a strong basis. When a single hour of downtime can cost hundreds of thousands of dollars, and large units can lose over a million dollars per day when they go down, preventing even a handful of power-related control failures can pay for robust UPS and protection schemes many times over. From a reliability advisorŌĆÖs perspective, ignoring the power side is one of the fastest ways to undermine the return on your automation investments.

Integrated control for petroleum refining is ultimately about alignment: aligning sensors, controllers, robots, AI, and business workflows with a power system and workforce that can support them every day, not just during a pilot. When that alignment is deliberate, refineries gain safer operations, more stable production, and a stronger position in a market that demands both reliability and responsibility. As you plan your next automation step, treating electrical reliability and power protection as first-class design parameters will do more for long-term performance than any single new algorithm or gadget.

Leave Your Comment