-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

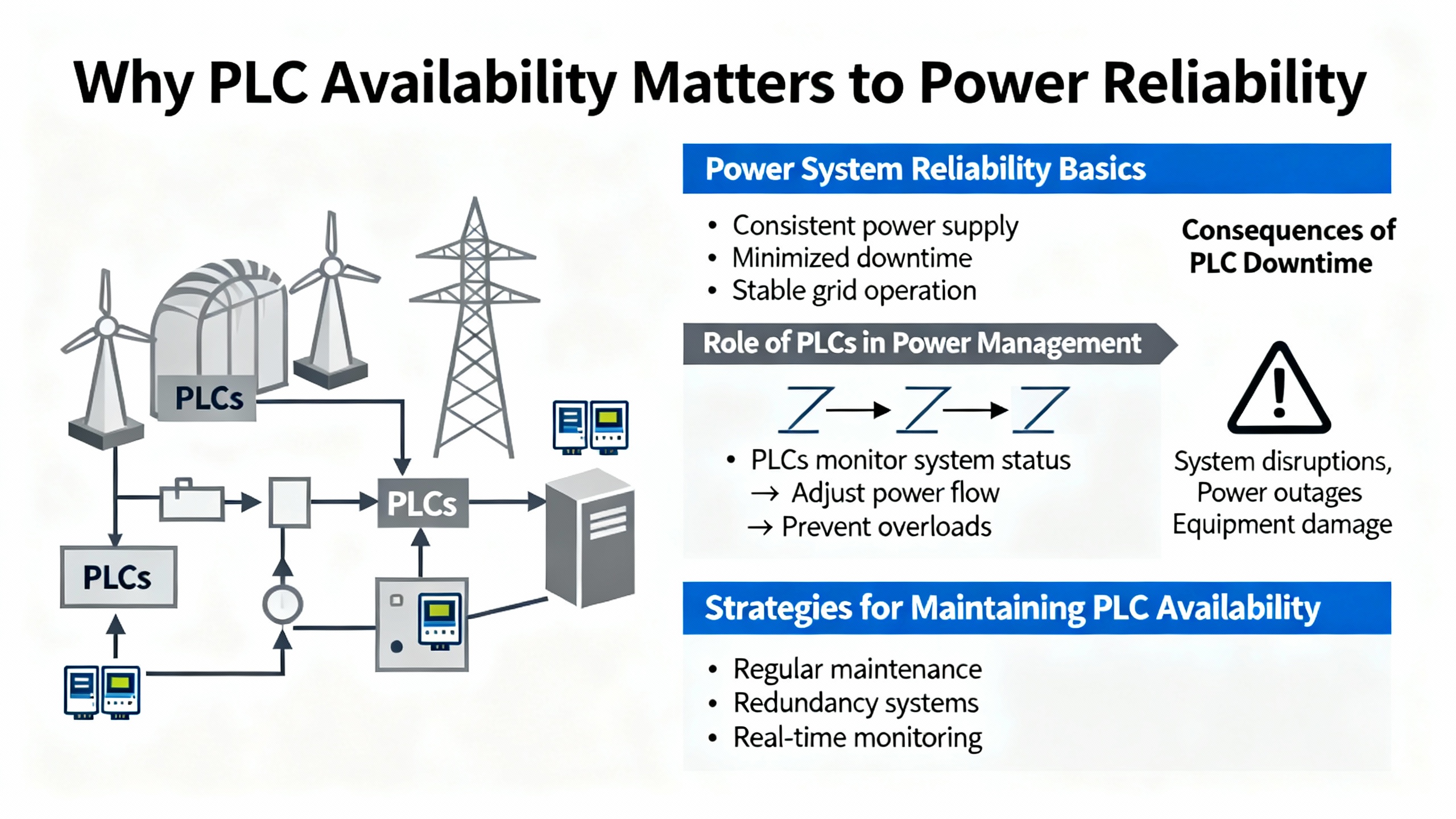

When you build or operate missionŌĆæcritical power systems, every control decision rides on a quiet cast of electronics: PLCs, I/O modules, network cards, and power supplies that sit behind your switchgear, UPS, and inverter front panels. In plants that standardized on Mitsubishi PLCs, those components often become single points of failure for transfer logic, load shedding, and protection interlocks. The question is not only which PLC brand you chose ten years ago, but where you are going to source reliable replacement parts tomorrow morning when a controller fails.

From a power system specialistŌĆÖs perspective, Mitsubishi PLC availability is not an abstract procurement issue; it is a reliability problem. A DigiKey TechForum article on PLC ŌĆ£soft requirementsŌĆØ reminds us that downtime in automated facilities routinely costs from hundreds to thousands of dollars per minute once idle labor, scrapped product, overtime, and lost goodwill are included. In critical power systems, a failed controller can also expose you to safety and compliance risks. Mitsubishi PLCs are solid controllers, but without a realistic sourcing and lifecycle strategy, even the best control platform becomes a liability.

This article walks through practical options for sourcing Mitsubishi PLC components and compatible alternatives, using experience from power projects together with guidance from engineering forums, automation distributors, and PLC brand overviews. The goal is straightforward: keep your UPS, inverter, and power protection schemes reliably controlled for the full life of the equipment, without painting yourself into a corner on parts availability or support.

PLCs are more than generic industrial computers. As described by Industrial Automation Co., they are ruggedized control systems that continuously read inputs from field devices, execute user logic, and drive outputs in real time. That loop controls breakers, contactors, static switches, motorized disconnects, and load banks in your power system. If the PLC or one of its key modules disappears from the supply chain, you inherit both operational and risk-management headaches.

A DigiKey TechForum article on longŌĆæterm PLC selection notes that PLC installations frequently remain in service for decades. It cites Rockwell AutomationŌĆÖs SLC 500 platform, introduced over thirty years ago and discontinued roughly ten years ago, as a realŌĆæworld example. Even today, secondŌĆæhand and repaired SLC modules are still traded to support installed systems. MitsubishiŌĆÖs own compact PLCs have comparable longevity: TRW Electric & Supply points out that Mitsubishi introduced its first compact PLC in Europe more than thirty years ago and now has over ten million compact controller installations worldwide.

That kind of lifetime is normal for power systems. Large UPS systems, MV switchgear, and plant distribution often run for twenty to thirty years with staged upgrades. The PLC that orchestrates static bypass, source transfer, or generator synchronization is likely to outlive several generations of IT hardware around it. Once your Mitsubishi PLC family moves from ŌĆ£activeŌĆØ to ŌĆ£matureŌĆØ and finally ŌĆ£discontinued,ŌĆØ your sourcing plan determines whether a single failed CPU or network card is a minor maintenance event or the trigger for an emergency migration.

Reliability is not only a hardware metric; it is an ecosystem issue. DigiKey emphasizes ŌĆ£softŌĆØ factors such as consistent PLC usage across a factory, workforce training, future modification costs, and external support. For a power system, that translates into technician familiarity during offŌĆæhours callouts, the ability to commission modifications safely years after the original programmer has retired, and the guarantee that spare parts and competent repair services are still available. All of that depends on your supplier choices.

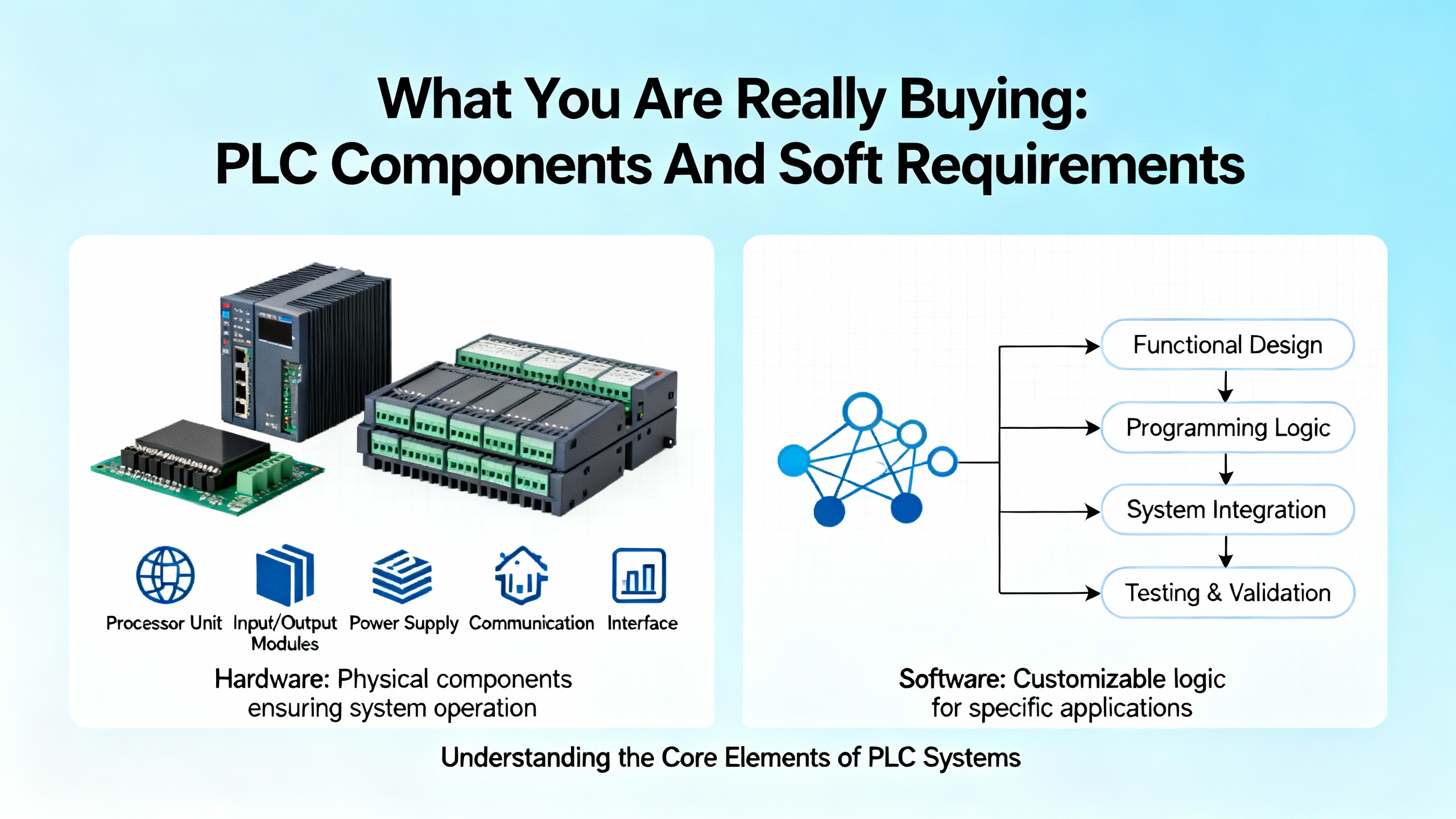

When teams talk about ŌĆ£finding a Mitsubishi PLC,ŌĆØ they often mean much more than the CPU. A controller stack for a UPS or switchgear lineŌĆæup typically includes the base PLC, discrete and analog I/O cards, highŌĆæspeed counters or positioning modules, network adapters, sometimes dedicated safety or motion modules, plus the programming software and licenses. Maple SystemsŌĆÖ guidance on PLC selection highlights how CPU performance, memory, communication ports, I/O mix, and power supply voltage all interact. SimconaŌĆÖs panelŌĆæbuilder perspective adds that scan time, power architecture, and communication protocols must be sized to the job.

Several sources, including Maple Systems and a Quora technical explanation of PLC behavior, stress that the PLC scan cycle is central. Inputs are read, program logic is executed, and outputs are updated in a continuous loop. For highŌĆæspeed protection functions or tightly coordinated transfer schemes, total scan time must be short enough to catch and act on transient conditions. That is one reason many facilities stay with a known PLC family: they have already demonstrated that familyŌĆÖs timing and determinism in their specific protection and control schemes.

However, Bob PetersonŌĆÖs contribution on an Automation & Control Engineering Forum makes a useful point: generic feature comparison charts between PLC brands are of limited value. He recommends creating three requirement tiers instead. First, define what is absolutely required for the application to be viable. Second, document what is strongly desired but not strictly mandatory. Third, list the ŌĆ£nice to haveŌĆØ items that are interesting but should not drive the decision. His observation is that most major PLC families comfortably satisfy the first two categories if the ŌĆ£requiredŌĆØ list is not artificially inflated. Real differentiation shows up in the last category.

DigiKeyŌĆÖs article extends that idea to ŌĆ£soft requirements,ŌĆØ which matter heavily in the field. Consistency across the facility reduces training burden and simplifies logistics, because a single PLC family tends to share accessories and engineering tools. Software strategy must match the skills of the workforce, whether you favor traditional ladder logic or newer highŌĆælevel languages. Future expansion should be assumed; a PLC should have headroom in CPU, memory, and I/O to accommodate new sensors, control modes, or remote monitoring. Education and support ecosystems, including manufacturer training, trade school coverage, and online communities, strongly influence longŌĆæterm viability.

Put simply, when you choose MitsubishiŌĆæcentric suppliers, you are not just buying modules; you are shaping who can support your power system ten or fifteen years from now, what kind of downtime you face when things change, and how painful an eventual migration will be.

For current Mitsubishi PLC families on active sale, your lowestŌĆærisk path is the official Mitsubishi channel: Mitsubishi Electric Automation and its authorized distributors and solution partners.

Mitsubishi Electric Automation in the Americas offers direct access to sales engineers via its contact channels. Those engineers support needs assessment for automation projects, including help selecting appropriate PLCs, drives, HMIs, and integrated solutions. For large power projects or major retrofits, engaging that team early can align your protection and control design with the product roadmap, firmware strategy, and longŌĆæterm availability plans.

Beyond direct sales, authorized distributors play a central role. ODOT Automation is explicitly described as an authorized distributor for Mitsubishi Electric PLCs, focusing on industrial automation. It emphasizes discount pricing, accessible price lists, and a broad product range that covers multiple models and configurations. Importantly, ODOT pairs product sales with technical support. Its team assists with model selection, installation, setup, and programming, positioning the company as a complete solution provider rather than a boxŌĆæmover. For a power project that needs consistent controller configurations across multiple switchboards or UPS lineŌĆæups, that combination of pricing, stock, and engineering support is valuable.

Regional Mitsubishi partners further extend this network. LC Automation in the United Kingdom describes Mitsubishi Electric as a key supply partner, providing PLCs, HMIs, inverters, servo systems, robots, and energyŌĆæsaving solutions. Its MEŌĆæENERGY starter packages, for example, bundle Mitsubishi technology into scalable energyŌĆæsaving systems for industrial customers. Gibson Engineering in North America likewise promotes MitsubishiŌĆÖs MELSEC PLC ranges, HMIs, VFDs, servo systems, and robots, all integrated via industrial Ethernet technologies such as CCŌĆæLink IE. It highlights engineering tools like GX Works3 that allow mixed IEC 61131ŌĆæ3 languages and reusable code libraries.

These partners matter because they sit at the intersection of product supply, application engineering, and lifecycle support. Compared with chasing individual modules on the open market, staying within the Mitsubishi ecosystem through recognized distributors offers several advantages for powerŌĆæcritical systems. You get currentŌĆægeneration hardware, current firmware, and an upgrade path. You have access to training, documentation, and factoryŌĆæbacked service. And you reduce the risk of counterfeit or mishandled electronics in your control panels, which is particularly important when the PLC is interlocked with UPS bypass and transfer schemes.

At some point, though, every PLC family reaches the end of its official life. That is where thirdŌĆæparty Mitsubishi specialists, surplus dealers, and repair houses come into play. They are indispensable if your installed base includes older MELSEC AŌĆæSeries or early QŌĆæSeries systems that still control critical switchgear, but they must be used with eyes open.

DO Supply positions itself as a buyer, seller, and repair provider for Mitsubishi components. It emphasizes help in locating rare Mitsubishi parts that customers struggle to source through standard channels and presents its team as Mitsubishi experts. The promise is not ŌĆ£something similar,ŌĆØ but the exact part number needed, which is critical when you are trying to match an existing PLC rack or replace a failed module in a validated power control scheme.

TRW Electric & Supply offers a more detailed view into the Mitsubishi landscape. It distributes both compact and modular Mitsubishi PLCs and related automation equipment, including Melsec AŌĆæSeries, System Q, and FX Series controllers, Melservo motion products, MDS servo and spindle drives, FREQROL drive families, and multiple generations of GOT HMIs. Most items are available new or refurbished, and TRW states that it typically provides a oneŌĆæyear warranty on both new and refurbished units. It also emphasizes its ability to repair many Mitsubishi series and to locate hardŌĆætoŌĆæfind or discontinued products, including legacy servo motors and drives that official distributors may no longer carry.

PDF Supply represents another category: surplus automation reseller rather than branded Mitsubishi partner. According to its own disclosures, PDF Supply is not an authorized distributor, affiliate, or representative of any brand it carries, including Mitsubishi and Rockwell. It sells used surplus products with its own limited warranty, not the original manufacturerŌĆÖs warranty. It also cautions that products may have older date codes or be from earlier series than those available from authorized channels, which can affect compatibility and lifecycle expectations. For AllenŌĆæBradley PLCs, PDF Supply notes that many units may ship with firmware already installed but explicitly does not guarantee that firmware will be present or at the revision level required for the customerŌĆÖs application. It makes no representation about the customerŌĆÖs ability or right to obtain or install updated firmware from the original manufacturer and will not supply firmware itself.

Those caveats are not unique to PDF Supply; they are part of the surplus market reality. For a powerŌĆæcritical Mitsubishi installation, refurbished or surplus modules can be an effective way to stretch the life of installed systems, but they shift more responsibility onto your engineering and maintenance teams. You must validate firmware levels, confirm compatibility across the rack, and stressŌĆætest any repaired modules under realistic load before connecting them to a live switchboard. The surplus dealerŌĆÖs warranty may cover replacement of a failed card, but it does not cover the broader consequences of an unexpected misoperation in a transfer scheme.

Used correctly, independent Mitsubishi specialists are strategic tools. For younger PLC families or nonŌĆæcritical applications, prioritize official and authorized channels. As the family ages and official availability shrinks, lean on MitsubishiŌĆæfocused surplus and repair firms with clear warranty terms and proven expertise. Keep surplus components in local stock for the most critical panels so you are not gambling on courier timing when a PLC fails during a stormŌĆærelated outage.

A Mitsubishi PLC cabinet is full of other hardware beyond the PLC rack: power supplies, sensors, relays, contactors, and pneumatic actuators. For many of these supporting components, you have more flexibility to use thirdŌĆæparty suppliers without disrupting the overall control strategy, as long as voltage levels, certifications, and environmental ratings are correct.

An extensive guide to industrial automation parts suppliers from OMCH frames downtime as the primary enemy of manufacturing. It describes a supply ecosystem that includes global OEMs such as Siemens, Rockwell, ABB, and Mitsubishi Electric; authorized distributors like DigiŌĆæKey, Wesco, and RS Group; costŌĆæeffective Asian brands; and surplus or obsolete specialists like Radwell and Santa Clara Systems. Each plays a different role: OEMs lead on technology and large projects, highŌĆæservice distributors shine in fast multiŌĆæbrand delivery, costŌĆæeffective suppliers help manage budgets on nonŌĆæcore parts, and surplus specialists keep legacy systems running.

Within that ecosystem, componentŌĆæfocused suppliers can be particularly valuable around a Mitsubishi PLC. OMCH itself, for example, operates as a ŌĆ£component supermarketŌĆØ for proximity and photoelectric sensors, power supplies, solidŌĆæstate relays, and pneumatics. It reports operating an approximately 8,000 square meter factory, supplying products with UL, CE, and RoHS certifications to more than one hundred countries, and pioneering mixedŌĆæcontainer exports so OEMs can order many product types in small quantities without bloating inventory. Omchele, a related automation company, describes a catalog of more than three thousand models across over thirty categories and two hundred series, with eightyŌĆæsix branches supporting about seventyŌĆætwo thousand business customers and assembling up to twenty million units annually.

For powerŌĆæsystem applications, these suppliers are often appropriate sources for sensor replacement, auxiliary power supplies, and panel components, provided that you respect the original design criteria. Maple Systems and Simcona both emphasize voltage compatibility and environmental durability in PLC selections. PLC I/O commonly uses 24 V DC for digital signals and analog ranges such as 0ŌĆō10 V or 4ŌĆō20 mA. Power components must be rated for the same voltages and environmental conditions as the original design. Simcona notes that typical PLC operating temperature ranges span roughly 32ŌĆō130 ┬░F, so harsher environments require appropriately rated enclosures and components.

Pulling this together, a pragmatic approach is to keep MitsubishiŌĆæbranded components where firmware, deterministic behavior, or safety certifications are tightly coupled to the PLC family, and to leverage highŌĆæquality component suppliers for generic items such as sensors and power supplies. That strategy preserves your control logic while broadening your sourcing options and, often, reducing cost without sacrificing reliability.

At some stage, the economics of sustaining an aging Mitsubishi platform with surplus parts may become less attractive than migrating to another PLC brand. Multiple sources provide useful perspective on how Mitsubishi compares with other PLC vendors and where alternatives may fit.

Industrial Automation Co.ŌĆÖs ranking of top PLC brands describes Siemens, AllenŌĆæBradley (Rockwell), Mitsubishi Electric, Schneider Electric, ABB, and Omron as major players, each with characteristic strengths. It notes that Siemens S7ŌĆæ1200 and S7ŌĆæ1500 controllers, working with the TIA Portal engineering suite, offer highŌĆæspeed processing and large memory, and that an automotive user reported cutting production downtime by thirty percent and improving quality control after applying S7ŌĆæ1500 and data analytics. RockwellŌĆÖs CompactLogix and ControlLogix systems, combined with Studio 5000 software, are positioned as tightly integrated control platforms; a food and beverage plant reported a twentyŌĆæfive percent efficiency increase and fifteen percent reduction in energy use after a Rockwell upgrade. Mitsubishi Electric, in the same ranking, is highlighted for compact and modular MELSEC PLCs, with base units starting around three hundred dollars and larger I/OŌĆæheavy systems reaching roughly one thousand five hundred dollars, and a packaging firm using the FX5U line was said to have increased output by twenty percent in six months thanks to scalable expansion.

Schneider ElectricŌĆÖs Modicon line is described as emphasizing reliability, energy efficiency, and strong connectivity, including Ethernet and Modbus, along with its EcoStruxure platform for IoT integration. A renewable energy company using a Modicon M580 reportedly achieved a twelve percent boost in windŌĆæturbine energy output while reducing downtime using predictive maintenance. ABBŌĆÖs AC500 PLCs are characterized as suited for harsh industrial environments; one mining deployment cited by Industrial Automation Co. achieved a forty percent reduction in equipment failures under extreme conditions. Omron focuses on compact allŌĆæinŌĆæone controllers that integrate well with robotics and vision systems; an electronics manufacturer using Omron CP1E PLCs for robotic soldering reportedly improved precision and cut defect rates by eighteen percent.

A comprehensive overview from PLC Department ranks PLC brands based on revenue, market share, innovation, and customer feedback. It notes that Siemens leads PLC makers by industrial automation revenue, around 18,281 million dollars, with operations in more than two hundred countries. Mitsubishi Electric is cited as the secondŌĆælargest PLC manufacturer with roughly 13,346 million dollars in industrial automation revenue, known for highŌĆæspeed processing and flexible programming, with MELSECŌĆæF controllers targeting highŌĆæspeed manufacturing and MELSECŌĆæQ optimized for complex process control. PLC Department also highlights ABBŌĆÖs AC500ŌĆæeCo V3 as an awardŌĆæwinning design and points out that ABB PLCs underpin critical infrastructure such as water and wastewater systems serving about 2.7 million people in Brazil, tying PLC choice directly to infrastructure reliability and sustainability goals.

Other sources underscore the geographic and application context. PEKO Precision notes that Siemens, Rockwell/AllenŌĆæBradley, Mitsubishi Electric, Schneider, ABB, Honeywell, and Omron are widely used PLC brands, and Simcona emphasizes that availability and supplyŌĆæchain risk, including lead times that can stretch toward a year during shortages, should be factored into brand decisions. PLC Technician training materials explain that in North America, AllenŌĆæBradley often holds a majority of the PLC market, whereas Siemens dominates in much of Europe. They recommend that technicians focus on the brand most prevalent in their target job region and, ideally, on the specific controller family already installed in their facility.

These perspectives do not suggest that Mitsubishi is a poor choice; on the contrary, they confirm that Mitsubishi is a globalŌĆæscale PLC vendor with strong offerings. For a plant already standardized on Mitsubishi, these comparisons are most useful in two scenarios: when a major system upgrade justifies evaluating an alternative platform for new projects, and when the installed Mitsubishi family is so far into its endŌĆæofŌĆælife phase that sourcing through surplus channels is no longer sustainable.

To help frame those options, it can be useful to summarize how different PLC brands are positioned in the sources discussed.

| Brand or group | Positioning from sources | Typical fit in a Mitsubishi strategy |

|---|---|---|

| Mitsubishi Electric | Compact and modular MELSEC PLCs with highŌĆæspeed processing, broad I/O and networking options, and strong presence in small and mediumŌĆæsized automation; secondŌĆælargest PLC manufacturer by industrial automation revenue according to PLC Department. | Continue as primary platform where installed base is large, spare supply is manageable through Mitsubishi channels and MitsubishiŌĆæfocused distributors, and workforce skills are already in place. |

| Siemens | HighŌĆæend SIMATIC families with advanced engineering via TIA Portal, very large global installed base, and proven benefits in reducing downtime and enabling analytics. | Consider for new highŌĆæcomplexity projects, especially where Siemens already dominates in the region or in adjacent systems, or where integrated analytics and future IIoT features are priorities. |

| AllenŌĆæBradley / Rockwell | Premium integrated control with deep services, training, and support; strong North American presence; case examples show efficiency and energy improvements after upgrades. | Attractive when aligning with North American industry norms or when Rockwell platforms already serve other parts of the facility and you want a single vendor ecosystem. |

| Schneider Electric | Modicon PLCs with strong energyŌĆæmanagement integration, EcoStruxure IoT platform, and documented gains in renewable energy applications. | Useful when energy efficiency and IoTŌĆæready architectures are central and when Schneider gear already exists in electrical distribution or building management. |

| ABB | Robust PLCs and automation for harsh environments, with notable use in critical infrastructure such as water and wastewater. | Suitable for heavy industry and infrastructure where ABB already supplies drives, motors, or grids, or where extreme conditions dominate design criteria. |

| Omron | CostŌĆæeffective PLCs that integrate with robotics and vision systems, emphasizing precision and defect reduction. | Consider in machineŌĆælevel projects or roboticsŌĆæheavy lines where Omron sensors and vision systems are already standard. |

| Delta and other costŌĆæeffective Asian brands | Described by OMCH as offering PLCs, drives, and servos similar in use to top brands at lower cost, with growing smart manufacturing and SCADA solutions. | Potential candidates for costŌĆæsensitive nonŌĆæcore systems or as part of a deliberate strategy to separate lowerŌĆæcriticality controls from highŌĆæcriticality power protection platforms. |

When you evaluate a shift away from Mitsubishi in any part of your plant, remember the earlier point from DigiKey and the Automation & Control Engineering Forum: focus on your required and strongly desired features and on soft requirements such as workforce skills, ecosystem support, and lifecycle costs. A cheaper controller that demands a full retraining of your technicians and exposes you to a thin local support network rarely saves money over the life of a UPS or switchgear lineup.

In practice, the best strategy for Mitsubishi PLC components is rarely ŌĆ£one supplier for everything.ŌĆØ A more resilient approach combines multiple channels, each mapped to its strengths, and is grounded in a clear, technically informed decision framework.

First, define what cannot change without reŌĆæengineering risk. That typically includes safetyŌĆæcritical functions, protection timing, and any logic tied to regulatory approvals. For those segments, prioritize official Mitsubishi channels and authorized distributors for as long as the product line remains supported. Where hardware is already discontinued, work with MitsubishiŌĆæfocused surplus and repair specialists such as TRW Electric & Supply or DO Supply, and build local stock of critical modules.

Second, separate core MitsubishiŌĆæspecific elements from generic components. According to Maple Systems and Simcona, digital and analog I/O modules, power supplies, and sensors need to meet specific voltage, speed, and environmental criteria, but they do not necessarily need to carry the PLC brand. OMCH and Omchele demonstrate how component superstores with thousands of models across many categories, backed by certifications like ISO, CE, UL, and national standards, can supply these elements reliably at good priceŌĆōperformance ratio. For power systems, this is especially relevant for panel power supplies and field instrumentation around the PLC.

Third, factor in workforce and regional realities. PLC Technician training materials and multiple brand overviews emphasize that AllenŌĆæBradley dominates many North American plants while Siemens is prevalent in much of Europe. If your technicians are already fluent in Mitsubishi tools and ladder logic, staying within the Mitsubishi ecosystem for powerŌĆæcritical controls minimizes downtime risk during troubleshooting and modifications. Conversely, if the plant already has a large Siemens or Rockwell footprint, and Mitsubishi is an isolated island, you may decide to converge on the majority platform during a scheduled upgrade.

Fourth, treat surplus purchases as engineering projects, not simple procurement events. PDF SupplyŌĆÖs disclaimers about older date codes, earlier series, and uncertain firmware highlight the care required with used controllers. Before installing a refurbished Mitsubishi module into a UPS bypass system, confirm firmware levels across the entire rack, simulate key sequences in a test environment when possible, and run structured commissioning tests that cover startup, shutdown, normal operation, and fault scenarios. A Practical Machinist discussion of PLCŌĆæbased systems reminds us that overall system reliability is the product of many individual steps; a machine with twenty sequential motions each at 99.9 percent reliability ends up near 98 percent overall. In a power system, you cannot simply assume that a swapped module restores the original reliability level without verification.

Finally, recognize that PLC choice and supplier choice are intertwined with cybersecurity, communications, and integration. Simcona notes that modern PLCs must address communication protocols, data collection, and cybersecurity, especially as IoT, remote work, and cloud connectivity increase. Brand ecosystems differ in their native protocols and security toolsets. PLC DepartmentŌĆÖs overview points out that some vendors emphasize IIoTŌĆæready architectures and sustainability targets. When PLCs control power assets that may be on the same networks as corporate systems, these considerations are part of the reliability conversation, not a separate IT issue.

Refurbished Mitsubishi modules from reputable specialists can be used safely, but only if they are integrated into a disciplined engineering and testing process. TRW Electric & Supply, for example, offers refurbished Melsec PLCs, drives, and HMIs with defined warranty periods and repair services, and DO Supply focuses on locating exact Mitsubishi part numbers, including rare items. At the same time, surplus resellers like PDF Supply stress that products may have older date codes and series and may ship with unknown firmware levels. For a critical UPS or switchgear controller, you should treat each refurbished module like a design change: verify firmware, confirm compatibility with existing racks, exercise all protection and transfer sequences during commissioning, and retain at least one additional spare for contingency. When those steps are followed, refurbished modules can extend system life without undermining reliability.

Migration is rarely justified by fashion; it is usually driven by lifecycle and support economics. If your Mitsubishi PLC family is still actively supported, available from authorized distributors, and well understood by your technicians, the simplest and often most reliable path is to stay with it, especially for powerŌĆæcritical controls. Migration becomes attractive when official support ends, spare parts are only available through surplus channels with uncertain history, or when new functional requirements, such as advanced analytics or tighter integration with plantŌĆæwide systems, are better addressed by another vendor. Industrial Automation Co. and PLC Department both show that Siemens, Rockwell, Schneider, ABB, and others offer strong, wellŌĆæsupported platforms with demonstrated benefits in areas such as downtime reduction, energy efficiency, and infrastructure reliability. The key is to plan migration during scheduled outages or major upgrade projects, not in reaction to a failure with no spares on the shelf.

DigiKeyŌĆÖs discussion of PLC lifecycle roles highlights how many people interact with a PLC over decades: system integrators and machine designers select the platform, engineers and technicians program and commission it, technicians service it, and future teams modify or extend it. For power systems, you should add protection engineers, electrical safety specialists, and operations managers to that list. Supplier and platform decisions should therefore be made collaboratively. Purchasing and supplyŌĆæchain teams bring insight into availability and lead times; engineering teams evaluate technical suitability, integration, and cybersecurity; maintenance and operations weigh in on ease of troubleshooting and training. When these perspectives are combined early, the result is a sourcing strategy that supports both reliability and total cost of ownership.

In power systems, PLC availability is directly tied to whether your UPS, inverters, and protective schemes behave as designed when the grid does not. By combining strong Mitsubishi channels, trusted surplus and repair specialists, and carefully chosen component suppliers, and by knowing when to consider alternative PLC platforms, you can keep that control layer as robust and maintainable as the copper and steel it supervises.

Leave Your Comment