-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

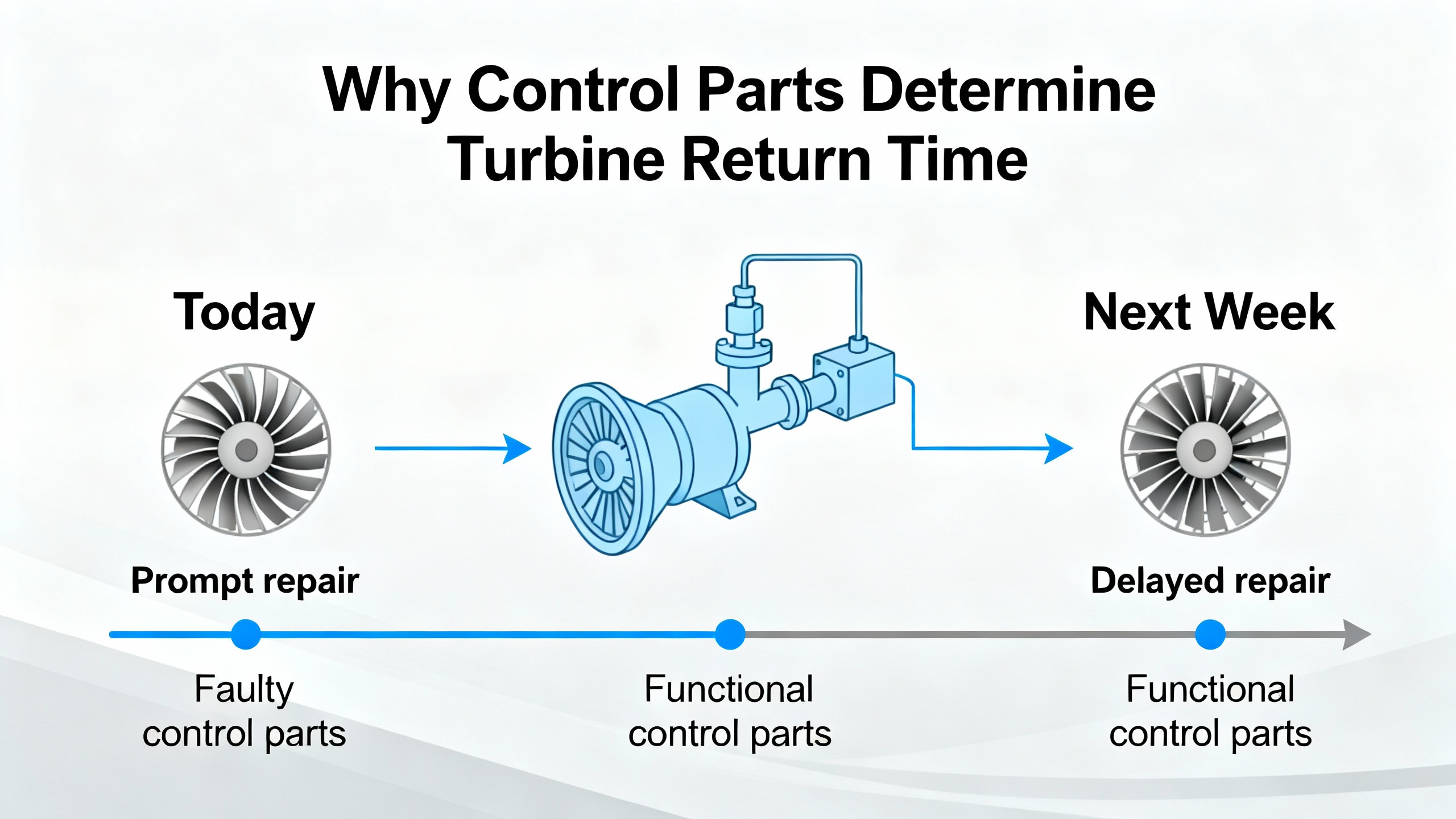

When a gas turbine trips on a control fault, the mechanical train is rarely the bottleneck. The real question is whether you can get the right control part in time: a sensor, an actuator, a valve positioner, a controller card, or a protection relay. As someone who spends a lot of time helping plants recover from forced outages, I have seen the same pattern repeatedly. The turbine is ready to run, but a single failed control module keeps tens or hundreds of megawatts off the grid.

Spare parts specialists in the turbine world have been sounding the alarm for years. Allied Power Group describes effective spare-parts management as the strategic sourcing, storage, and care of components so the right parts are on hand when needed, not just a random pile of hardware sitting in a warehouse. Prismecs quantifies the downside of poor planning with a simple example: if your outage costs about $10,000.00 per hour, a single 24-hour unplanned stop translates to about $240,000.00 in lost production. GE Vernova reports that in a steam turbine fleet, nearly half of outages are unplanned and those unplanned events add roughly three and a half days of downtime and about $150,000.00 in lost generation on average.

None of those numbers are for gas turbine controls specifically, but they capture one truth. When the unit is down unexpectedly, every hour matters. An urgent gas turbine control parts supplier is not a nice-to-have. It is part of your core reliability architecture, right alongside your UPS systems, switchgear, and protection relays.

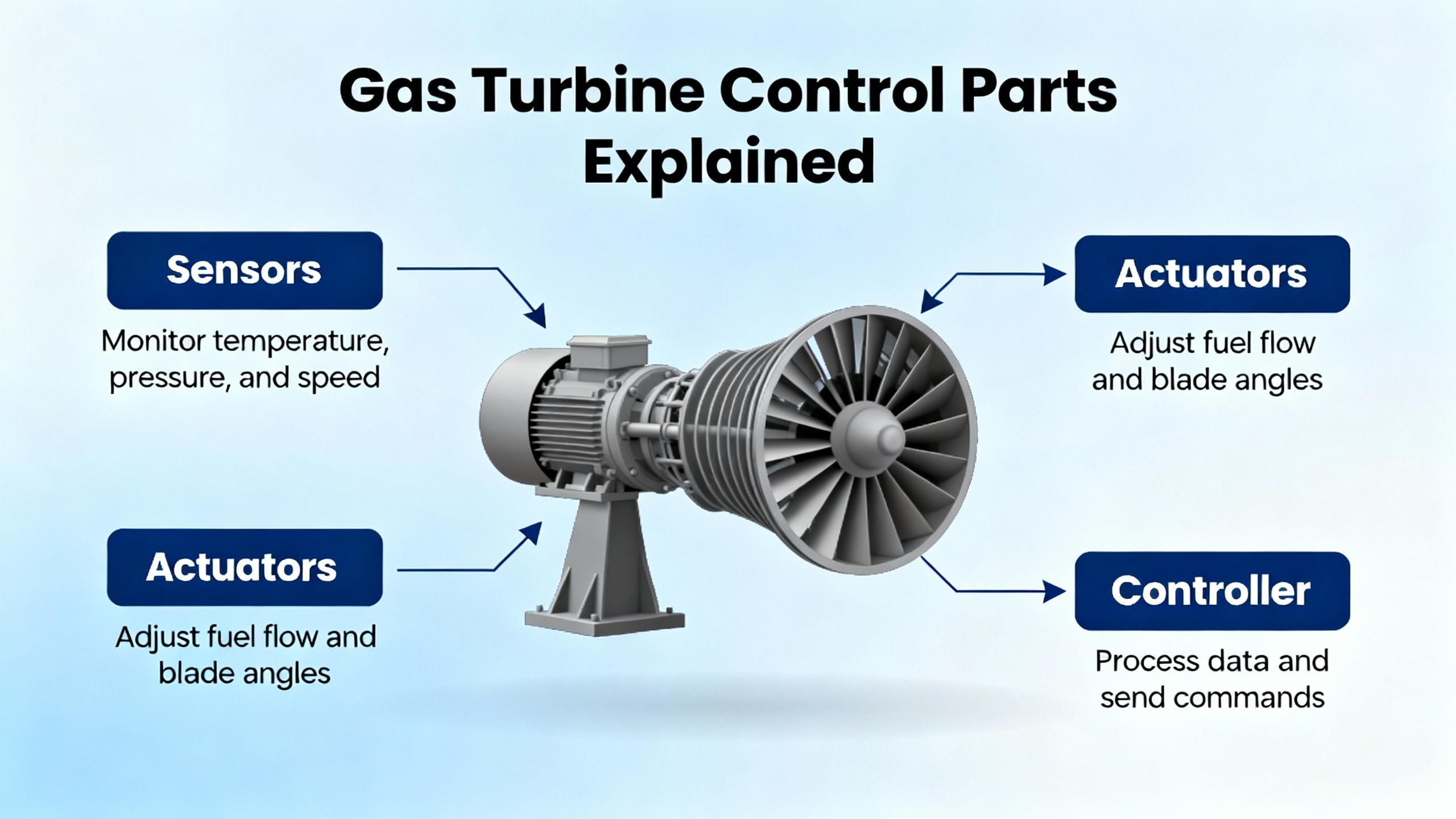

Gas turbine control systems sit at the intersection of performance, safety, and asset life. Gas Turbine Controls experts emphasize that controls govern fuel delivery, combustion conditions, rotor speed, and temperature limits, and they enforce safety protections and emissions constraints. The hardware behind that intelligence includes sensors and transmitters, actuators and valves, controllers and I/O modules, along with their panels, wiring, and software.

These components are different from a typical mechanical spare. A worn seal or minor casing crack might be managed with derating or temporary repairs. A failed speed sensor, actuator, or controller can instantly prevent a safe start or force a trip. Gas Turbine Controls guidance stresses that regular inspection, calibration, and functional testing of sensors and controllers are the first line of defense against unexpected failures, and that redundant architecture and backup devices are essential wherever downtime is unacceptable.

That means a gas turbine control parts supplier is not just shipping boxes. In practice, they are protecting your ability to measure, decide, and act in real time, which is exactly what your turbine needs to stay online.

Many operators assume they can simply pay for expedited freight when something fails. The research on turbine spare-parts inventory shows that is an expensive illusion. Allied Power Group points out that balanced inventory levels are the only way to avoid choosing between excessive capital tied up in stock and crippling downtime when a needed part is missing. The right answer depends on criticality and lead time. Some items can be sourced in days. Others are made-to-order and have no meaningful expedite option.

Prismecs highlights that supply-chain delays and incorrect forecasts are common drivers of stockouts. Their recommendation is to treat spare parts management as a predictive, data-driven discipline. That means recording every stockout, every delay, and every failure, then adjusting stocking strategies accordingly instead of relying on gut feel. SafetyCulture makes the same point at a broader industrial level. They note that inaccurate inventory records and a poor handle on demand lead directly to unexpected downtime when technicians discover that ŌĆ£availableŌĆØ parts are nowhere to be found.

For control parts, the risk is amplified because many of them are either single points of failure or are tied to complex compatibility requirements. A controller card for a specific vintage of gas turbine, or an obsolete relay with a particular firmware level, might take weeks or months to procure if you do not plan ahead. A credible urgent supplier helps you avoid that situation by combining strategic planning with emergency execution.

GE Vernova describes three main approaches to control spare parts: classic on-site storage, centralized storage, and vendor managed inventory. Each has its place in an emergency maintenance strategy.

In the classic model, each plant buys and stores its own set of spares. The advantage is obvious. If a control card fails, the replacement is already in your warehouse, and response time is limited mostly by your crewŌĆÖs ability to diagnose, swap, and test. The trade-offs are also clear. You carry high upfront capital costs, some parts may never be used before they age or become obsolete, warranty clocks can start long before installation, and there can be tax implications for inventory on site.

Centralized storage aggregates spares in one national or regional facility serving multiple plants. GE Vernova notes that this typically allows delivery within a few days while reducing duplicated inventory and avoiding customs-related delays compared with international shipments. It improves efficiency but concedes some response speed. In a true control-system emergency, waiting several days can still be painful unless you have enough redundancy and load flexibility to ride through.

Vendor managed inventory takes the idea further. The supplier owns and manages the stock on the customerŌĆÖs behalf. According to GE VernovaŌĆÖs PartSmart program, plants only purchase parts when they are actually used. That avoids early warranty start dates and the carrying costs of large on-site inventories. The trade-off is longer lead time because the parts are not necessarily held at your plant, or even in your country. For sites that can tolerate waiting about a week or two for control parts, the cost benefits can be compelling. For plants that must be back in service within hours, vendor managed models must be combined with a reserved set of critical on-site spares.

This comparison can be summarized as follows.

| Storage model | Typical access time (from GE Vernova) | Capital and carrying cost | Main advantage | Key risk in emergencies |

|---|---|---|---|---|

| On-site plant stock | Immediate once fault is diagnosed | Highest; stock may never be used | Fastest recovery and minimal dependence on others | Obsolescence, early warranty start, tax on inventory |

| Centralized storage | A few days | Lower than duplicating at each site | Balance of cost and speed across a fleet | Still too slow for some forced control failures |

| Vendor managed (VMI) | Roughly a week or two | Lowest direct holding cost for plant | Vendor handles planning and obsolescence | Lead time may be unacceptable for critical control use |

In practice, an urgent control parts supplier often operates across all three models. They help you decide what absolutely must sit at the plant, what can be shared in a regional warehouse, and what can safely live in vendor managed stock.

Prismecs suggests a simple way to move the conversation from ŌĆ£too expensiveŌĆØ to ŌĆ£too risky.ŌĆØ Calculate how much one hour of downtime costs, then multiply by realistic outage durations and compare the result with the cost of stocking spares. Their example uses $10,000.00 per hour, which leads to about $240,000.00 for a 24-hour unplanned outage. That is a useful reference point for gas turbine operators.

Using that same assumption, the financial impact of control-parts lead times looks very different.

| Scenario | Outage duration assumed | Example downtime cost at $10,000/hour (from Prismecs method) |

|---|---|---|

| On-site control spare, fault resolved same day | 4 hours | About $40,000.00 |

| Centralized store, part arrives in 2 days | 48 hours | About $480,000.00 |

| Vendor managed inventory, 1 week to get part | 168 hours | About $1,680,000.00 |

These are simplified calculations, but they illustrate the point. Saving the cost of a spare control card today can easily expose the plant to seven figures of lost generation later. GE VernovaŌĆÖs steam turbine outage data, which shows that unplanned events add several days and about $150,000.00 of additional lost generation on average, points in the same direction. For control parts, where a single failure can immobilize the entire unit, the economic case for a planned urgent supply strategy is even stronger.

An urgent control parts supplier is much more than a shipping center that stays open late. When you look across the recommendations from Allied Power Group, Prismecs, SafetyCulture, Gas Turbine Controls specialists, GE Vernova, Yichou, MD&A, EPRI, and SS&A Power Consultancy, a consistent pattern appears. The best partners combine inventory, engineering, quality, and logistics in one integrated service.

GE VernovaŌĆÖs Lifecycle Review service is a good template. It starts with an assessment of the hardware currently installed in the turbine controls and the spares you already own. The review identifies obsolete cards, gaps in coverage, and opportunities to optimize what is held on site versus centrally or in a vendor managed program. Allied Power Group and Prismecs advocate the same approach for turbine spares more broadly: classify parts by how critical they are and by their function, then align stocking policies with that classification and with observed failure patterns.

An urgent supplier takes that analysis and designs a specific control-spares portfolio for your units and your outage philosophy. Critical elements like key controllers, power supplies, essential sensors, and actuator components that would immediately prevent a safe start are planned as fast-access items, whether they live in your cabinets or in a nearby warehouse. Function-specific or efficiency-related parts can be assigned longer lead times.

MD&A emphasizes that supporting both planned and forced turbine outages requires 24/7 readiness, with engineering and technical experts available around the clock. SS&A Power ConsultancyŌĆÖs case study in the United Kingdom shows what that looks like in practice. A more than 20-year-old gas turbine suffered a critical combustor failure at a time when the original manufacturer no longer produced the part. Buying a new combustor would have left the unit down for about 48 weeks, jeopardizing supply during the winter peak.

Instead, SS&A leveraged their industry network to locate identical combustor parts from another plant upgrading the same turbine type. They organized the commercial transaction, sent a team on site to inspect the hardware, reviewed historical inspection reports, and carried out non-destructive testing to confirm the parts were fit for another major cycle. Within a few weeks rather than nearly a year, the turbine was back in service before the high-demand season.

That story is about combustors rather than control cards, but the lesson transfers directly. An urgent control parts supplier needs a comparable network and the ability to mobilize quickly, whether that means pulling a rare controller from fleet stock, sourcing an obsolete module from a secondary market, or deploying field engineers to validate a proposed substitute in front of your insurance inspector.

When you are forced to look beyond the original manufacturer for control parts, engineering and quality assurance become just as important as speed. EPRIŌĆÖs guidance on procuring gas turbine buckets and nozzles, while focused on hot gas-path hardware, illustrates the expectation. Their technical update builds procurement around established standards from ASTM, SAE, and ANSI, and adds more than a dozen specific casting-related standards on top of an existing set. The aim is to reduce technical and reliability risk by formalizing how quality is specified and inspected when sourcing non-OEM parts.

YichouŌĆÖs work on high-quality gas turbine components echoes the same message. They emphasize strict compliance with global standards such as ISO and ASME, precision machining, non-destructive testing, and high-temperature endurance assessments. They also highlight the risk of counterfeit and substandard parts, which can lead to premature failures, safety hazards, and expensive repairs.

A credible urgent control parts supplier applies that same discipline to electronic and electro-mechanical components. They validate that control modules are genuinely compatible with your turbine model and control platform, that they have been tested appropriately, and that firmware and software versions are correct. They provide documentation, traceability, and, where needed, engineering justification for using aftermarket or alternate-brand components.

Obsolescence is where an emergency supplier earns their reputation. The SS&A case shows how simply reverse-engineering a combustor, while technically possible, would have introduced additional risk, cost, and schedule uncertainty. Instead, they used their knowledge of the fleet and available units worldwide to find proven hardware that had already run successfully.

MD&A describes similar challenges in turbine fleets where OEM parts are either obsolete or cost-prohibitive. Their solution is a combination of reverse engineering, advanced diagnostics, and life-extension analysis, but always within a structured framework that respects standards and provides auditable quality. For control parts, the equivalent capability includes knowing where compatible modules are still in service, understanding which versions can be safely interchanged, and being able to advise when reverse engineering or redesign is justified and when it is not.

Emergency supply is only half the story. Gas Turbine Controls specialists, MaintWiz, and SafetyCulture all argue that the most effective maintenance is proactive and condition-based. Sensors, transmitters, and controllers are continuously monitored; critical key performance indicators and trend data are analyzed; and maintenance actions are scheduled based on actual condition rather than on fixed calendars alone.

An urgent control parts partner can reinforce that strategy by integrating with your computerized maintenance management system. SafetyCultureŌĆÖs guidance on CMMS describes the value of real-time stock tracking, automated reorder points, and linkage between work orders and spare parts usage. In that model, a control card that shows elevated failure risk in your predictive analytics can automatically trigger a pre-emptive order or a pull from vendor stock long before it fails during peak demand.

Gas Turbine Controls best practices also highlight the importance of keeping control software current with the latest versions and security patches. That is now a core part of reliability, not just an IT concern. Many cyber incidents in industrial environments start with outdated, unpatched systems. An urgent control parts supplier that understands controls holistically will provide not only physical modules but also guidance on firmware baselines, patch management, and rollback plans, so that emergency hardware replacements do not introduce software mismatches or new vulnerabilities.

Choosing a third-party turbine service partner has a major impact on reliability and lifecycle cost. MD&AŌĆÖs guidance on selecting non-OEM service providers is directly applicable to control parts suppliers. They recommend prioritizing providers with proven experience on your specific turbine and generator models, backed by case studies, outage reports, and references from similar plants. Depth of in-house engineering, adherence to ISO and ASME codes, and use of established protocols such as those from EPRI are all strong indicators of quality.

Field execution capability is just as important. MD&A points to the need for experienced project managers and technical directors, strong safety performance, schedule discipline, and the ability to coordinate multiple scopes in parallel. For control-system emergencies, that translates into technicians who can diagnose complex faults in the field, make sound recommendations about part replacement versus repair, and execute changes safely under time pressure.

On the parts side, MD&A stresses robust support including expedited manufacturing, reverse engineering for obsolete components, and proactive inventory strategies tailored to your fleet. Yichou adds another dimension by warning against counterfeit and poorly documented components. Combined with PrismecsŌĆÖ caution about using out-of-brand parts only with great care, these sources make a clear case. Working with non-OEM control parts is acceptableŌĆöoften advantageousŌĆöif and only if the supplierŌĆÖs engineering, quality systems, and transparency are strong enough to manage the additional risk.

Turning these principles into a practical plan takes some deliberate work. The starting point is to quantify your downtime cost. Prismecs suggests calculating a realistic lost-production figure per hour, then using that to evaluate stocking decisions. Once you know whether an additional day or week of outage represents tens of thousands of dollars or several million, it becomes easier to justify capital tied up in critical control spares.

Next, map your control system in detail. Identify which sensors, actuators, controllers, communication modules, and protection devices are essential for starting and loading the turbine safely. Gas Turbine Controls guidance can help define that list, since they focus on sensors, actuators, valves, and controllers as the core elements of safe and efficient operation. Classify each part by criticality and by whether its failure stops production entirely or merely reduces efficiency.

After that, choose a storage model for each class of control part. Use the on-site, centralized, and vendor managed options that GE Vernova outlines, but tailored to your outage risk and fleet structure. Truly critical items, especially those with long lead times or obsolescence risk, should be stocked on site or in the nearest warehouse your supplier operates. Parts that mainly affect efficiency can be held centrally or in vendor managed stock, where cost savings justify slightly longer response times.

Integrate this plan with your maintenance processes. MaintWiz and SafetyCulture both emphasize that preventive maintenance is most effective when it is linked with spare parts management. Every inspection, calibration, and repair on a control component should create or update a record in your maintenance system and should be reconciled with your parts inventory. That is how you learn which control modules are wearing out faster than expected and where your stocking assumptions need to be updated.

Finally, formalize the relationship with your urgent control parts supplier. Borrow from MD&AŌĆÖs recommendations on third-party partners. Agree on response expectations for daytime and off-hours calls. Define how engineering support will be provided during emergencies. Set up routine lifecycle reviews to keep your control parts strategy aligned with evolving failure data, hardware obsolescence, and fleet age.

There is no universal number, but the research points to a structured approach. Allied Power Group and Prismecs both recommend classifying spares by criticality and lead time. For control parts that can immediately prevent a safe start and have long lead times or obsolescence risk, many operators choose to hold at least one complete set of critical modules on site, with additional coverage via centralized or vendor managed inventory. For less critical control hardware, it is often more economical to rely on an urgent supplierŌĆÖs regional stock, provided the resulting lead time does not expose you to unacceptable downtime costs based on the calculation method Prismecs describes.

They can be, but only when sourced and qualified correctly. YichouŌĆÖs work on gas turbine components shows that high-quality aftermarket parts can match or even exceed OEM performance if they are built to standards such as ISO and ASME and subjected to rigorous non-destructive testing and endurance trials. EPRIŌĆÖs guidelines for buckets and nozzles reinforce the importance of basing procurement on formal standards from organizations like ASTM and SAE. For control hardware, the same principle applies. If an aftermarket supplier can demonstrate compliance with relevant standards, provide full documentation and test results, and show a track record on your turbine model, then their parts can be a safe and cost-effective option. If they cannot, the risk of hidden defects, incompatibilities, or counterfeit components is too high for critical control applications.

Classic on-site spares mean your plant owns the parts and stores them locally. GE Vernova notes that this model provides the fastest possible response and minimal dependence on external logistics, but it also ties up capital, starts warranties early, and exposes you to inventory tax and obsolescence risk. Vendor managed inventory, as implemented in programs like PartSmart, leaves ownership and planning with the supplier. Your plant pays for parts when they are used, avoiding carrying costs and early warranty consumption. The trade-off is longer lead time, often around a week or more, because the parts are not sitting in your warehouse. For control parts that would shut down the turbine, a hybrid approach is usually best. Keep a core set of critical modules on site and use vendor managed inventory for the broader portfolio.

Emergency maintenance on gas turbine controls is a bad time to discover that the one part you need is on a 12-week lead time. Treating control parts with the same discipline you apply to your protection systems and turbine major components, and partnering with an urgent supplier that combines inventory, engineering, and quality, turns those emergencies into manageable events instead of existential threats to your generation schedule.

Leave Your Comment