-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

Variable frequency drives sit right at the intersection of power quality, process control, and equipment life. In industrial and commercial power systems, ABB drives are common in everything from chilled water plants and air handlers to process pumps and critical ventilation. When one of those drives fails, becomes obsolete, or suffers from long lead times, you are forced into a highŌĆæstakes decision: stay with ABB at all costs, or qualify an alternative supplier.

Multiple market studies show that the variable frequency drive market is not only large but still expanding. One MarketsandMarkets analysis projects the global VFD market will grow from about $24.68 billion in 2025 to $32.00 billion by 2030, a compound annual growth rate of roughly 5.3%. Another forecast cited by Zhejiang Chuanken Electric puts the market at about $29.9 billion by 2026, with annual growth around 6.8%. That growth is driven by the same pressures you feel every day: energy efficiency mandates, automation, decarbonization, and the need to protect critical loads.

In that context, ABB is one of several global manufacturers capable of meeting demanding applications. Reports from Hars VFD and MingCH both list ABB alongside Siemens, Schneider Electric, Danfoss, Rockwell Automation, Yaskawa, Fuji Electric, Eaton, WEG, and Johnson Controls as leading VFD providers. You are not locked into a single logo, but changing brands on a live plant is not trivial. The challenge is to maintain or improve reliability, efficiency, and controllability while limiting risk to connected loads, power protection equipment, and operations.

This article walks through how to think about ABB drive replacements, which alternative manufacturers are trusted in the market, and which sourcing channels typically deliver dependable support. The focus is practical and grounded in published guidance on VFD selection, packaging, and supplier vetting rather than on marketing hype.

Before choosing an alternative, it helps to be clear about what the drive is doing for your system today. ABBŌĆÖs portfolio covers several applicationŌĆæspecific families, as described by Inverter Drive Systems. ACS drives serve as generalŌĆæpurpose machinery drives across diverse industries such as automotive, food and beverage, printing, agriculture, material handling, and sawmills. They handle both constant torque and variable torque applications, including conveyors, compressors, pumps, fans, and mixers.

For building HVAC, ACH drives are tuned specifically to control the AC motors that move air and water through a facility. They can work with induction motors, permanent magnet motors, and synchronous reluctance machines, and they include HVAC setup assistants, buildingŌĆæmanagement system integration, and even safety features such as FiremanŌĆÖs Override, which forces extraction fans to run to destruction to clear smoke during a fire.

ACQ drives focus on water and wastewater pumping. They simplify multiŌĆæpump coordination and maintain energy efficiency for raw, clean, and wastewater treatment applications. ABB also offers micro drives for simple, lowŌĆæcost duties, ATEXŌĆæcertified variants for hazardous areas, waterŌĆæcooled drives when panel space is tight, regenerative drives for highŌĆæbraking applications, and ultraŌĆælow harmonic drives for power quality constrained networks.

In HVAC, Industrial Automation Co. highlights several ABB ACH580 and ACH550 models used on air handlers, chilled water pumps, and cooling tower fans. They note that retrofitting these loads with VFDs typically cuts energy use on those loads by about 20 to 50%, while improving comfort, reducing noise, and extending equipment life. That is the baseline your replacement must match or improve.

In short, an ABB drive in your oneŌĆæline diagram is rarely a simple black box. It encodes assumptions about the motor, the torque profile, the environment, and the control system. Any alternative supplier has to be evaluated against that full context, not only against horsepower and price.

The first constraint is still the motor and the driven load. A VFD, sometimes called an AC drive or inverter, controls motor speed and torque by varying the frequency and voltage of the power supplied to the motor. Technical guidance from TSLŌĆæME emphasizes that the drive must match the motorŌĆÖs voltage, frequency, fullŌĆæload amperage, and type. Most drives are designed for standard threeŌĆæphase AC induction motors, but not all support permanent magnet or synchronous motor types, so you need to confirm compatibility explicitly.

Load type is just as important. ConstantŌĆætorque applications such as conveyors and mixers need high starting torque and higher overload capability. VariableŌĆætorque applications such as fans and pumps are where you gain the most energy savings at reduced speeds, and you may be able to use a more efficient drive sizing strategy. The HVACŌĆæfocused article from Industrial Automation Co. reinforces this by noting that fan and pump specific control modes, sleep and wake logic, and variableŌĆætorque optimization are core features for energyŌĆæefficient HVAC drives.

When replacing an ABB drive with a different brand, you want the new driveŌĆÖs torque performance and overload ratings to match what the process actually needs rather than what the nameplate horsepower suggests. TSLŌĆæME advises basing VFD selection primarily on the motorŌĆÖs fullŌĆæload amperage and application type, not just horsepower, and that guidance remains valid regardless of brand.

Space, temperature, humidity, and contaminants determine whether a standŌĆæalone drive module or a packaged drive is more appropriate. Joliet Technologies makes a useful distinction here. A standŌĆæalone VSD module is a selfŌĆæcontained converter or inverter with builtŌĆæin controls that produces adjustable output from the supply. A packaged drive adds an enclosure, disconnects, overcurrent protection, doorŌĆæmounted controls, terminations, and thermal management in one integrated assembly.

Joliet notes that when you are replacing an existing drive with the same rating and similar configuration, a standŌĆæalone module is often sufficient because existing upstream protection, disconnects, and cabinets can usually be reused. But if you are upsizing the motor and drive, or if the original installation barely met cooling and clearance requirements, you may need to revisit the entire arrangement, including upstream protective devices.

Ambient conditions drive enclosure selection. Joliet lists common options ranging from open chassis designs around IP00ŌĆōIP20, through NEMA 1 and NEMA 12 equivalents, up to NEMA 4 or 4X for washdown or outdoor locations. Packaged drives often place a lowerŌĆæcost openŌĆæchassis VSD inside a higherŌĆærated enclosure with appropriate ventilation or cooling systems so that both the drive and any sensitive components stay within temperature and humidity limits.

Humidity and airborne contaminants matter too. Typical VSD humidity limits are about 5 to 95% relative humidity, nonŌĆæcondensing. In humid or outdoor environments, Joliet points out that packaged drives may incorporate fans, heaters, or even airŌĆæconditioning units to prevent condensation and control both humidity and temperature, because conformal coating alone provides limited moisture protection. Dust, oil, and corrosive substances all argue for properly rated enclosures and filtration.

Alternative brands such as Invertek and Danfoss explicitly target these environmental needs in their product lines. Industrial Automation Co. calls out Invertek Optidrive Eco units with IP66 outdoorŌĆærated enclosures and integrated disconnects for rooftop fans and outdoor fan coil units, as well as an IP55 model for larger pumps and process cooling loads. Danfoss VLT HVAC Drive FC 111 is described as a compact IP20 drive well suited for tight mechanical rooms and retrofit panels. When you move away from ABB, you want to be sure the alternative can match the existing enclosure rating and thermal performance, or that you are ready to adjust the mechanical design to suit.

The drive also sits on your control network and in your safety architecture. TSLŌĆæME notes that modern VFDs often support industrial communication protocols such as Modbus and Ethernet/IP and may need to integrate with existing PLC or automation systems. For HVAC, Industrial Automation Co. stresses the importance of builtŌĆæin BACnet, Modbus, or other buildingŌĆæmanagementŌĆæsystem friendly protocols.

If your current ABB ACH or ACS drive is integrated tightly into a PLC or BMS, an alternative from Siemens, Schneider Electric, Danfoss, or Rockwell Automation must provide equivalent protocol support and I/O. Otherwise, you may need protocol converters or program changes that significantly expand the scope of the project.

Safety and compliance are nonŌĆænegotiable. TSLŌĆæME recommends features such as Safe Torque Off, overload, shortŌĆæcircuit, and groundŌĆæfault protections, along with appropriate certifications such as UL, CE, or CSA. ABB is one of the few manufacturers offering ATEXŌĆæcertified motor and drive packages for hazardous areas, as Inverter Drive Systems points out. When replacing those units with another brand, you must ensure the alternative has the correct hazardousŌĆæarea approvals or accept that ABB may remain the only viable option for that particular duty.

VFDs dissipate heat, typically on the order of a few percent of their rated power. Joliet reminds us that drives typically dissipate about 3% of their rated power as heat, and packaged drives are designed with the right ventilation or cooling to manage that heat for both the drive and any other components in the enclosure. When you substitute another manufacturerŌĆÖs drive, you cannot assume identical thermal behavior. Checking required cooling clearances and considering the cumulative heating of drive plus control components is part of a reliable design.

Power quality considerations also enter into replacement decisions. Inverter Drive Systems notes that ABB offers ultraŌĆælow harmonic drives based on active rectifier technology where minimizing harmonic distortion is a key requirement, along with regenerative drives where there is a high regenerative load. Equivalent solutions exist from other suppliers, but you should verify that a proposed alternative can meet any harmonic limits imposed by your utility or internal standards, especially in facilities that already rely heavily on UPS, inverters, or sensitive instrumentation.

Reliability is not only about mean time between failures; it is also about how quickly you can recover when something goes wrong. ABBŌĆÖs own channel partners program is structured to pair ABB products with partners that emphasize product availability, afterŌĆæsales support, engineering expertise, systems integration, and service capabilities. Partners at different tiers commit to specific requirements and ongoing compliance, which is one reason many facilities standardize on ABB for critical systems.

At the same time, realŌĆæworld service ecosystems extend beyond any single manufacturer. Hoffman Mechanical Solutions in the United States, for example, specializes in commercial and industrial HVAC solutions built around ABB VFDs and Daikin VRV systems. They provide ABB system startup and commissioning, custom service agreements, training for facilities staff, and warranty support across a broad range of ABB components, including AC drives, DC drives, inverters, soft starters, and bypass units. SFC Energy in Canada emphasizes expert guidance for submersible pump VFDs, including cable length, voltage spikes, and motor insulation issues.

TSLŌĆæME explicitly recommends consulting experienced suppliers or service providers when requirements are complex or uncertain, noting that they need to understand both process demands and the technical nuances of different VFD brands and models. Whether you stay with ABB or move to another manufacturer, aligning with a partner who can support commissioning, diagnostics, and lifecycle maintenance is as important as the drive hardware itself.

Several independent sources, including Hars VFD, MingCH, and TSLŌĆæME, converge on a set of global manufacturers whose drives routinely stand alongside ABB in industrial and commercial installations. When facilities replace ABB drives with alternatives, these are the brands most often considered.

| Manufacturer | Source characterization and strengths | Representative product focus |

|---|---|---|

| Siemens | Uses advanced control algorithms and stateŌĆæofŌĆætheŌĆæart technology; strong coverage of industrial drives, HVAC, and renewable applications. | SINAMICS G120 and S120 drives for modular, highŌĆæpower uses. |

| Schneider Electric | Markets VFDs under Altivar and Lexium brands; emphasizes robust design, advanced functionality, and tight integration with its automation suite. | Altivar and Lexium drives for process and machine applications. |

| Danfoss | Known for energy efficiency and applicationŌĆæspecific drives such as VLT HVAC and VLT AQUA, targeting building automation and water processes. | VLT HVAC and VLT AQUA for pumps, fans, and compressors. |

| Rockwell Automation | Offers AllenŌĆæBradley PowerFlex drives, including highŌĆæpower, safetyŌĆæenhanced, and connectivityŌĆærich variants for heavy industries. | PowerFlex 755T and related families for demanding applications. |

| Yaskawa | Recognized for motion control excellence and versatile AC drives suitable for many industrial loads. | GA800 Industrial AC Drive and U1000 Matrix Drive. |

| Fuji Electric | Provides compact, highŌĆætorque drives suitable for harsh environments, with a focus on efficiency. | FRENICŌĆæAce and FRENICŌĆæMEGA drive lines. |

| Eaton | Integrates drives with power management solutions; focuses on intuitive interfaces and rugged designs. | PowerXL DG1 and SVX9000 for industrial and utility contexts. |

| WEG | Known for robust construction serving process industries with integrated motorŌĆædrive solutions. | Industrial drive families matched to WEG motors. |

| Johnson Controls | Targets large building HVAC with integrated VFDs in its building automation platforms. | Metasys variable speed drives for HVAC. |

| MingCH | Chinese manufacturer with modular, highŌĆæefficiency mediumŌĆævoltage drives used in several international markets. | MINGCH MV Series drives for industrial applications. |

| Hars | Focuses on industrial automation; its VFDs target threeŌĆæphase AC asynchronous motors with highŌĆæperformance vector control and strong overload. | Hars VFD lines, with more than 200,000 units reportedly in use. |

These manufacturers are not interchangeable, but they do offer credible alternatives when ABB drives are unavailable, uneconomical, or outside your standardization strategy.

Siemens and Rockwell Automation are often considered when you want deep integration with existing control platforms or when you already rely on their PLC and automation ecosystems. Schneider Electric and Eaton appeal where you are standardizing on their broader energy management suites. Danfoss and Johnson Controls are particularly strong in building HVAC, mirroring much of what ABBŌĆÖs ACH line provides. Yaskawa and Fuji Electric bring a strong heritage in motion control and compact drives, while MingCH and Hars illustrate the rise of regional manufacturers that have built substantial installed bases in industrial automation.

A reliable drive requires a reliable supply chain behind it. Recent work highlighted by Flex emphasizes that competitive manufacturers and their customers must manage four durable shifts in manufacturing: agility and customer centricity, supply chain resilience, speed and productivity, and ecoŌĆæefficiency. FlexŌĆÖs Pulse Risk Management tool applies AI and machine learning to bills of materials to give early, partŌĆælevel risk insights and mitigation options. That same mindset applies to your VFD sourcing strategy.

ABB works with a structured network of channel partners rather than open informal resellers. Partners are carefully selected and mapped into several levels of partnership, each with defined requirements, responsibilities, and benefits. Some partners emphasize product availability and logistics, while others lead with engineering expertise, systems integration, or lifecycle service.

When your priority is a likeŌĆæforŌĆælike ABB replacement on a critical asset, this network is often the fastest way to secure the correct drive variant, firmware, options, and documentation. It also helps preserve extended warranties and gives you straightforward access to ABBŌĆÖs own service divisions for base services, spare parts, upgrades, and smart service solutions that sit on top of drives and motors.

In many regions, the most practical route to an ABB alternative is through a multiŌĆæbrand distributor or integrator that works daily with ABB plus competing lines. Hoffman Mechanical Solutions, for instance, positions itself around ABB VFDs and Daikin VRV systems, but in practice its technicians handle integration, diagnostics, and replacement of a broad range of ABB components, including bypass units and control systems. SFC Energy offers similarly specialized support for submersible pump drives, emphasizing that cable length, voltage spikes, motor insulation, and installation details can make or break an installation.

Industrial Automation Co. reviews ABB HVAC drives alongside Invertek and Danfoss options for rooftop fans, tower fans, and chilled water pumps, and recommends standardizing on a limited set of drive families across ABB, Invertek, and Danfoss to simplify spares, training, and commissioning. That is a practical model for many facilities. Rather than treating ABB as the single standard, you can define one or two approved alternatives from other global manufacturers and work with a distributor who understands all of them.

Inverter Drive Systems in the United Kingdom serves a similar role with ABBŌĆÖs own portfolio, helping users select between ACS, ACH, ACQ, micro, ATEX, regenerative, and ultraŌĆælow harmonic drives. Whether you use that service for ABB or for other brands, the key is to rely on a partner who is comfortable with the detailed application engineering, not just shipment of boxes.

When cost pressures or regional supply chain realities push you toward less familiar brands, due diligence becomes critical. An overview of ABB VFD suppliers compiled by Accio highlights how global ABB drive supply is heavily concentrated in China, with major clusters in Guangdong and Beijing and secondary hubs in Jiangxi, Fujian, and Guangxi.

Accio recommends looking at operational benchmarks such as onŌĆætime delivery rates of at least 95% (preferably closer to 98%), rapid response times on the order of one to three hours, and reorder rates above 20 to 30% as proxies for customer satisfaction. Compliance and quality baselines should include ISO 9001 certification and documented adherence to ABBŌĆÖs technical specifications for electrical compatibility, voltage control, and harmonic performance.

They outline a verification process that includes crossŌĆæchecking supplier claims with thirdŌĆæparty audit reports or verified transaction histories, analyzing reorder and onŌĆætime delivery metrics, requesting samples for stress testing with a focus on voltage stability and harmonics, and conducting onŌĆæsite inspections that look for calibrated production lines and electrostaticŌĆædischarge safe assembly areas. They note that direct manufacturers usually maintain tighter process control than trading companies and that factory size and layout can reveal much about a supplierŌĆÖs ability to scale.

Those principles apply equally when you are buying alternative drives from regional brands like MingCH or Hars. These companies may offer very competitive pricing and acceptable quality for many applications, but you want evidence that their controls, power stages, and production processes can support the duty cycles and environmental conditions of your facility.

Supplier directories such as Thomasnet catalog VFD suppliers and can be useful starting points for market scanning. A locally cached snapshot of a Thomasnet page for ABB drives showed only metadata rather than full listings, but the general pattern is clear: directories aggregate suppliers, locations, and basic capability descriptions to help engineers and purchasing teams identify candidates.

As with any aggregation site, the key is not to treat directory entries as sufficient proof. A practical approach is to use them to build a long list, then apply the more rigorous verification steps outlined above, including manufacturer documentation review, direct technical discussions, and, where the risk justifies it, formal audits or lab testing.

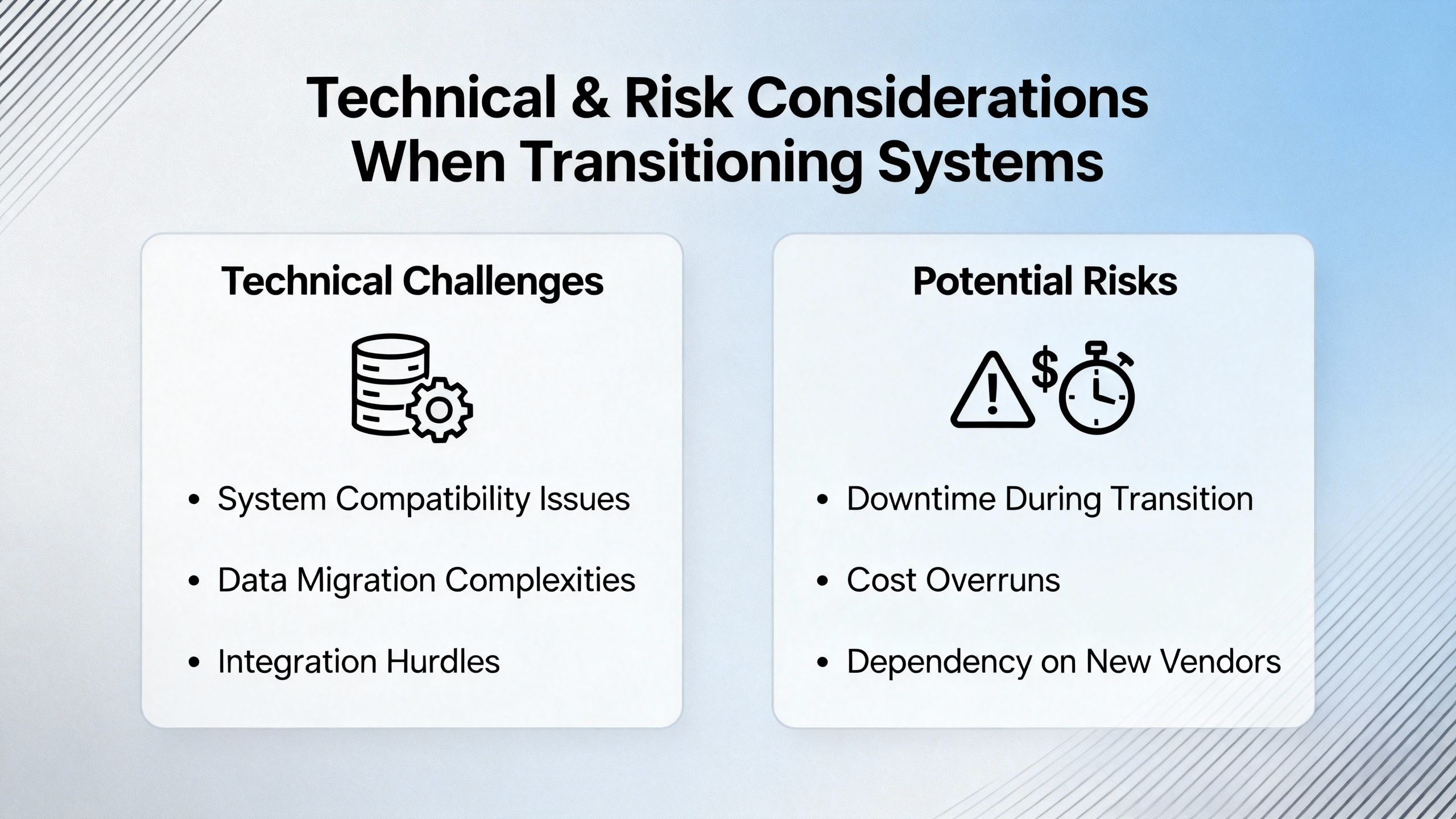

Once you have identified candidate alternative suppliers and channels, it is time to think through the technical and risk implications of actually swapping out an ABB drive.

TSLŌĆæME emphasizes that VFDs are strategic assets that improve energy efficiency, reduce mechanical wear, enhance process control, and minimize downtime in manufacturing, HVAC, and pump stations. That value does not disappear when you change brands, but it can erode if selection and commissioning are rushed.

SHCKELE highlights 2025 trends such as smarter, connected VFDs with IoT and AI capabilities that support realŌĆætime monitoring, performance analytics, and predictive maintenance. They cite projected growth rates around 12% for IoTŌĆæintegrated VFDs and around 10% for advanced control algorithms, reflecting demand for better data and smarter control. That suggests an opportunity: if you must replace an ABB drive anyway, you may be able to step up to more connected hardware from a trusted competitor, provided that your cybersecurity and OT practices can absorb it.

Energy efficiency and sustainability remain central themes. Many top manufacturers explicitly aim to reduce carbon footprint and operating costs by lowering energy consumption in variableŌĆætorque loads such as pumps and fans. Industrial Automation Co. points out that even modest speed reductions on large cooling tower fans or process pumps can translate into thousands of dollars per year in avoided energy costs. Maintaining those savings when you change brands means validating that the alternative drive has comparable control modes, sleep functions, and optimization algorithms.

From a supply chain perspective, FlexŌĆÖs experience across global manufacturing networks shows that organizations who systematically address agility, supply chain resilience, speed and productivity, and ecoŌĆæefficiency through advanced manufacturing and analytics investments are better positioned to deliver at scale. In VFD terms, that means knowing which brands you will accept ahead of time, qualifying them technically, and maintaining enough transparency into your suppliersŌĆÖ capacity and risk profiles to avoid surprises.

Finally, remember that VFD installations are part of a larger power system. Drives can interact with UPS systems, power quality meters, and protective relays. If your existing coordination studies, selective trip curves, or harmonics analyses were based on ABB drive characteristics, any alternative should be evaluated in that context. In many cases, a direct replacement from another tierŌĆæone manufacturer will behave similarly, but assumptions should be checked for critical feeders and sensitive loads.

Three broad patterns emerge in drive replacement projects, and each one calls for a slightly different sourcing and engineering strategy.

In HVAC systems where an ABB ACH drive fails on a critical air handler or cooling tower fan, a likeŌĆæforŌĆælike ABB replacement through an authorized channel partner often minimizes risk, especially if the plant already uses ABB extensively. If lead times or budget make that impractical, Danfoss VLT HVAC drives or Johnson ControlsŌĆÖ buildingŌĆæintegrated drives are common alternatives, as both are recognized in market analyses as leaders in HVAC VFDs. In many of these cases, the control interface and communications mapping are the main engineering tasks, since the underlying fan or pump load is well within the capability of any tierŌĆæone drive.

In water and wastewater pumping, ABB ACQ drives can often be replaced by Danfoss VLT AQUA or SiemensŌĆÖ waterŌĆæfocused SINAMICS configurations. Here, the details around multiŌĆæpump control, surge avoidance, and any existing softŌĆæstart sequences become important. TSLŌĆæME notes that VFDs can manage multiple motors if all motors start and stop together and the drive is sized for the combined load, but each motor still requires its own overload protection. When changing brands, it is good practice to review pump control strategies and protective settings rather than attempting a blind parameter translation.

In industrial plants running mixed fleets of drives, it is common to standardize over time on one or two vendors in addition to ABB. Hars and MingCH both describe broad industrial deployments of their drives, and MingCH notes strong international penetration in markets such as Russia and Southeast Asia. Many North American and European plants similarly standardize on Rockwell AutomationŌĆÖs PowerFlex or Siemens SINAMICS lines. In these scenarios, ABB drives are often replaced opportunistically as they fail or as production cells are upgraded, with the plant gradually moving toward fewer drive families. To keep that strategy safe, the TSLŌĆæME recommendation to maintain a formal checklist of mustŌĆæhave features, integration requirements, maintenance needs, safety functions, and connectivity should be followed rigorously during each replacement.

In all of these patterns, field experience aligns with the published guidance: the plants that fare best are those that treat VFD replacements as engineering changes rather than as commodity swaps, and that involve both electrical and mechanical stakeholders plus controls and operations early in the process.

Often you can, as long as the new drive is compatible with the motorŌĆÖs voltage, frequency, fullŌĆæload current, and type, and provides the required starting torque and overload performance. TSLŌĆæME emphasizes sizing primarily on motor fullŌĆæload amperage and application type. You still need to check environmental ratings, harmonics, and control integration, and to confirm that the motor insulation system can handle the new driveŌĆÖs switching characteristics, especially on long cable runs.

Not necessarily. Industrial Automation Co. notes that retrofitting fans and pumps with modern HVAC drives from ABB, Invertek, and Danfoss typically cuts energy use on those loads by about 20 to 50%. Other top manufacturers such as Siemens, Schneider Electric, Yaskawa, and Rockwell Automation also design drives explicitly for high efficiency in variableŌĆætorque applications. The key is to match the driveŌĆÖs control modes and features to your load, rather than assuming energy performance is identical across all models.

Guidance compiled by Accio for ABB VFD suppliers is broadly applicable. Look for ISO 9001 certification and documented adherence to relevant drive specifications, review onŌĆætime delivery and reorderŌĆærate metrics, request and test samples with an eye on voltage stability and harmonic performance, and conduct site visits where practical to confirm production quality. Favor direct manufacturers over pure trading companies when longŌĆæterm fleet support is important.

A disciplined approach to supplier risk, paired with careful technical qualification, can make lowerŌĆæcost alternatives a viable part of your drive strategy without sacrificing reliability.

In critical power and process environments, a failed drive is more than a nuisance; it is a direct challenge to uptime, energy performance, and safety. Treating ABB VFD replacement as an engineering and supply chain problem rather than a simple purchasing task is what separates resilient facilities from those that are constantly reacting. With a clear view of your application, a short list of trusted global and regional manufacturers, and partners who understand both the electrical and operational stakes, you can replace ABB drives confidently while protecting the broader power system around them.

Leave Your Comment