-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

Modern power and process plants live and die by the stability of their control and power infrastructure. When you run critical UPS-backed control rooms, medium-voltage switchgear, and inverter-fed drives, your Distributed Control System (DCS) and power protection architecture either keep the lights on or turn a minor disturbance into a plant-wide trip. That is why any discussion about replacing an ABB DCS is never just an IT decision; it is a power system reliability decision.

From the field perspective, owners usually sit between two pressures. On one side, aging ABB platforms such as Symphony, INFI 90, or older System 800xA versions inch toward obsolescence. On the other, new architectures promise virtualization, open interfaces, and better integration with electrical protection, UPS, and business systems. This article walks through realistic alternative paths, grounded in published information from ABB, Rockwell Automation, Honeywell, ARC Advisory Group, Cross Company, and others, and framed from the standpoint of keeping your power supply and protection dependable while you evolve or replace your ABB DCS.

A DCS is an automation system that distributes controllers and I/O around the plant, connects them over industrial networks, and brings everything back to centralized operator and engineering workstations. Global technical references explain that typical DCS architectures combine controllers, remote and local I/O, HMIs, engineering tools, alarm management, historians, and often asset and condition monitoring. The big difference from a simple PLC plus SCADA setup is how deeply everything is integrated and how much the system is designed around plant-wide continuous and batch processes.

ABBŌĆÖs portfolio reflects this integrated model. ABB Ability System 800xA is positioned in industry comparisons as more than a traditional DCS. It also acts as an electrical control system and safety system, managing the full electrical distribution chain from high-voltage switchgear down to low-voltage motor control. It leverages digital communication with intelligent devices to reduce hardwired cabling and to eliminate separate electrical measurement equipment because rich data is available directly from field devices. Symphony Plus and its SDe Series hardware continue that approach in large continuous-process and power-generation environments, while the Freelance family targets smaller and mid-size process plants.

ABB also continues to evolve its platforms. Freelance 2024, for example, adds PROFINET connectivity and Ethernet Advanced Physical Layer (Ethernet-APL) support for faster, more reliable communication, and it introduces NAMUR Open Architecture connectivity via OPC UA and Module Type Packages for modular automation. It runs on modern operating systems with integrated security tools, and ABB explicitly positions it as a future-proof platform that builds on more than 30 years of Freelance experience.

When you look at your current ABB system, you are not just evaluating logic and graphics. You are assessing the backbone that coordinates protection relays, breaker controls, UPS status, inverter alarms, and large motor or drive trips that keep the plant safe.

In a perfect world, you would evolve a DCS smoothly over the full life of the plant, and the manufacturer would always keep you on a direct upgrade path. ABBŌĆÖs own ŌĆ£why and when to upgradeŌĆØ material effectively argues for that approach: incremental, planned evolution rather than sporadic large projects. Real sites, however, do not always follow this ideal. Over decades, systems get frozen at older versions, expansion projects bolt on islands of PLC and SCADA, and cybersecurity expectations rise.

Industry-wide, Rockwell Automation has estimated that the global installed base of end-of-life DCSs is on the order of tens of billions of dollars, with many systems more than 25 years old. ABB and other vendors highlight similar concerns. Across ABB case studies and third-party analyses, the same drivers show up repeatedly.

Technical and lifecycle triggers include rising hardware failure rates, shrinking spare part availability, vendor notices that software will no longer be supported, and operating systems that can no longer be patched to acceptable cybersecurity levels. Plants also struggle when they can no longer integrate new fieldbus technologies, intelligent electrical devices, or modern analytics and historian tools into aging platforms.

Operational performance is another motivator. ABB modernization cases describe improvements such as a 75% production capacity increase at an alumina refinery, 15% productivity and 25% energy efficiency gains at a Norwegian aluminum plant, and more than 50% better basis-weight control with 20% better moisture control on a paper line after DCS evolution projects. Owners whose units underperform peers naturally ask whether their legacy DCS and control strategies are part of the problem.

Finally, there are workforce and business factors. Knowledge of older ABB platforms can be concentrated in a few senior engineers. When those experts retire or move on, plants find themselves dependent on external contractors for even routine changes. At the same time, corporate strategies push for tighter integration between operational technology and business systems, higher cyber maturity, and more flexible production. All of this leads decision-makers to ask whether to modernize in place with ABB or to move to an alternative DCS.

The least disruptive alternative to a wholesale replacement is to keep ABB as the core platform while evolving hardware and software in stages. ABB has deliberately built service offerings around this strategy under the banner of extensions, upgrades, and retrofits.

ABBŌĆÖs extensions, upgrades, and retrofits portfolio focuses on modernizing installed DCSs, both ABB and third-party, with minimal disruption. The emphasis is on preserving field wiring and I/O wherever possible, introducing new operator interfaces, controllers, and integration layers in phases. Case studies span power generation, metals, mining, pulp and paper, chemicals, cement, and other sectors, often with upgrades executed during short planned outages rather than long shutdowns.

From a power-system standpoint, this approach has three concrete advantages.

First, it protects proven protection and interlock logic. Conversion tools preserve existing control logic and libraries, then move them into modern ABB libraries. That means your carefully tuned load-shedding schemes, breaker interlocks, generator start sequences, and UPS transfer logic are adapted rather than rewritten from scratch. The risk of misinterpreting original design intent is lower.

Second, it reduces work on the electrical side of the house. ABB modernization emphasizes reusing cabinets, terminal blocks, and field cabling, whether for Symphony Plus, Harmony, INFI 90, or other installed systems. The Symphony Plus SDe Series, for example, provides one-to-one module replacements and space-fit mounting options for Harmony Rack installations. Field-side assets remain intact while control-side hardware is renewed. For plants, that means less disturbance to switchgear rooms, cable trays, and UPS-fed panels, and fewer opportunities for wiring errors that could compromise protection.

Third, it stabilizes budget and outage planning. ABBŌĆÖs own upgrade guidance describes strategies such as replacing the power supplies of a 50-cabinet system in groups of five per year over a decade. Instead of facing a single risky ŌĆ£big bangŌĆØ project, owners can spread cost and risk, aligning incremental upgrades with routine outages.

Freelance 2024 and the SDe hardware portfolio give owners two practical evolution paths. Freelance offers a modern, scalable DCS that can serve as a drop-in replacement for older nodes and PLC islands, and it interfaces with modern Ethernet-based field networks. The SDe Series targets installed base modernization at thousands of sites, particularly in power generation, water, oil and gas, pharmaceuticals, and pulp and paper, allowing reuse of existing cabinets, wiring, and termination units while adopting new control and I/O modules.

The main limitation of staying within the ABB ecosystem is strategic rather than technical. If corporate direction is to standardize on a different DCS vendor, to adopt a more open platform, or to break perceived vendor lock-in, then even a well-managed ABB evolution may not satisfy that mandate. In those cases, alternative DCS platforms must be evaluated.

When owners talk about ŌĆ£ABB DCS alternatives,ŌĆØ they usually mean one of three things. Some want to replace ABB with another full-featured DCS. Others want to consolidate ABB and non-ABB systems into a single platform, which may or may not be ABB. A third group wants to move from a traditional DCS to a more open, virtualized control environment aligned with emerging standards from organizations such as NAMUR and the Open Process Automation Forum.

One publicly discussed comparison is between ABB Ability System 800xA and Schneider ElectricŌĆÖs EcoStruxure Foxboro DCS. Both target large, complex process plants and support high availability and rich plant-wide information.

System 800xA is positioned as a combined DCS, electrical control system, safety system, and collaboration platform. Its integrated electrical control manages the full distribution chain and uses digital links to intelligent devices, which reduces hardwired cabling and separate measurement equipment.

EcoStruxure Foxboro DCS is presented as a family of fault-tolerant, highly available control components that consolidate critical process information. A distinctive feature is its embedded real-time accounting models designed to measure and control the financial value of every point in the process, directly linking control actions to economic performance.

A simplified comparison highlights how they differ conceptually.

| Aspect | ABB Ability System 800xA | EcoStruxure Foxboro DCS |

|---|---|---|

| Core positioning | DCS plus electrical control, safety, and collaboration platform | DCS focused on fault tolerance and financial performance modeling |

| Electrical integration | Built-in electrical control from high-voltage switchgear to low-voltage motor control using digital communication to intelligent devices | Emphasis more on process control, with electrical integration depending on broader EcoStruxure ecosystem |

| Economic optimization | Improves engineering efficiency, operator performance, and asset utilization | Embeds configurable real-time accounting models to measure economic value of process variables |

| Typical strength | Deep integration of process, electrical, and safety systems; reduction in hardwired cabling | Very high fault tolerance and direct linkage of control to financial performance metrics |

For power system and protection engineers, the key takeaway is that System 800xAŌĆÖs strength lies in integrating electrical control and protection with process control, while Foxboro DCS differentiates itself by embedding economics into the control model. If you rely heavily on System 800xAŌĆÖs ability to manage intelligent switchgear and motor control centers, replicating that behavior in another platform requires a careful look at electrical integration capabilities and may demand additional power management or substation automation systems.

HoneywellŌĆÖs PlantCruise, derived from its Experion PKS technology, illustrates another class of ABB alternatives. PlantCruise is targeted at small and mid-size manufacturing and process plants that have often grown around multiple stand-alone PLCs and separate SCADA or HMI islands. HoneywellŌĆÖs own whitepaper notes that such islands can drive higher lifecycle costs, more engineering effort, and greater operational risk than a modern integrated DCS.

PlantCruise is described as modular and scalable, with pre-engineered control templates and library-based function blocks intended to cut engineering time and configuration errors. Architecturally, it uses distributed controllers and I/O with Ethernet-based networking, redundancy options, centralized engineering tools, and integrated diagnostics and alarm management. It supports open standards such as OPC and industrial Ethernet protocols, which simplifies integration with existing equipment and higher-level business systems and reduces vendor lock-in.

PlantCruise and similar systems are particularly relevant when your installed ABB footprint is relatively small, or when ABB is only one of several control platforms on site. In those cases, the choice may hinge on which vendor offers the strongest lifecycle services, regional support, and integration into the rest of your digital stack, rather than purely on traditional DCS functionality.

ARC Advisory Group and Rockwell Automation both emphasize a broader trend: the convergence of enterprise, cloud, and industrial control software. ARC highlights that DCS vendors are beginning to adopt cloud-derived software tools such as containers and orchestration technologies, and recommends that end users ask pointed questions about vendorsŌĆÖ roadmaps for virtualization, cloud-native architectures, and open-source tooling.

Virtualization is not just an IT buzzword in this context. ARC notes that virtualizing industrial control systems can reduce total cost of ownership, extend system life, minimize disruptive changes, and significantly reduce obsolescence risk. Rockwell adds that modern DCS platforms can reduce architectural footprint, enforce consistency via native process objects, and make cyber-hardened architectures easier to implement.

In practical terms, that means an ABB replacement project should not only compare controller performance and graphics libraries. It should also examine how each candidate platform handles virtual machines or containers for engineering and operator stations, how it approaches patching and disaster recovery, and how it supports concepts like ŌĆ£late bindingŌĆØ of I/O using characterizable or configurable modules. Those characterizable and configurable I/O designs, described by ARC, allow hardware and software lifecycles to be decoupled so that control strategies can be fully designed and tested before final hardware is fixed.

Whether you evolve with ABB or move to an alternative platform, the strategy you adopt for migration will drive your risk and your power system exposure far more than the brand name on the cabinet.

From ABBŌĆÖs modernization literature, RockwellŌĆÖs DCS migration guidance, and case studies from integrators such as Cross Company, a few patterns emerge.

One is stepwise hardware evolution with aggressive reuse of I/O and wiring. ABBŌĆÖs modernization approach, HoneywellŌĆÖs recommendations for PlantCruise, and similar strategies all favor reusing cabinets, field wiring, and termination units. ABBŌĆÖs SDe Series in particular is designed for one-to-one module replacement in Harmony and INFI 90 environments, allowing you to renew control hardware without disturbing field-side connections. This is invaluable for power protection because it reduces the number of terminations that must be touched on trip circuits, breaker controls, and protective relay outputs. Every untouched termination is one less chance for a mis-landed wire.

Another pattern is coexistence and parallel operation. Cross Company describes migrating aging PLCs to ABB Freelance nodes as an intermediate step, with custom I/O cables and interfaces that support side-by-side operation of existing PLCs and new ABB nodes. This allows live migration while processes run, with the ability to fall back to proven hardware if issues arise. RockwellŌĆÖs guidance on hot cutover similarly involves running old and new systems in parallel, then migrating loops incrementally during short outages or even online where process risk allows.

Virtualization also changes the game. Once your DCS servers, engineering stations, and historians are virtualized on UPS-backed host infrastructure, you can stand up full pre-production environments that mirror your live protection and control configurations. ARC and ABB both emphasize that such environments reduce upgrade risk and facilitate continuous modernization. For power systems, this means you can validate load-shedding logic, breaker controls, and UPS or inverter interaction sequences in a controlled environment before touching the live plant.

Finally, effective modernization aligns with plant lifecycle planning. ABB explicitly recommends budgeted upgrade programs that spread changes across years, and Rockwell notes that phased migrations minimize downtime and spread capital cost. When upgrades are aligned with planned outages and maintenance windows, you avoid the painful combination of long unplanned downtime and major control changes under pressure.

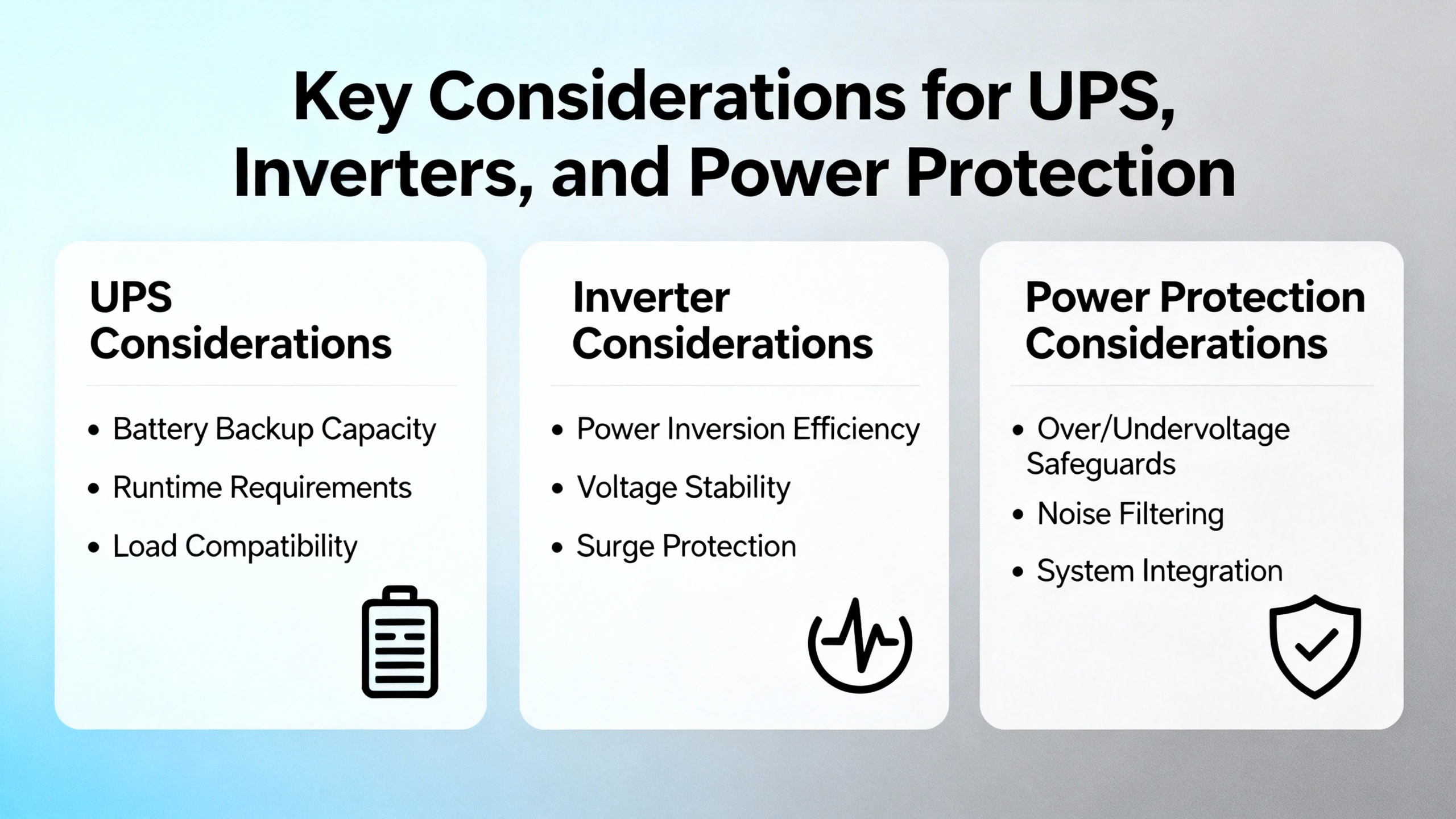

From a power system specialistŌĆÖs viewpoint, the DCS migration plan should be judged by how it handles a few critical interfaces: UPS-backed supply to the control system itself, control of protective devices and breakers, and coordination with inverters and drives.

In most plants, DCS servers, engineering workstations, and network equipment live on UPS-backed panels to ride through short disturbances and allow orderly shutdowns during longer outages. As you modernize or replace an ABB DCS, you can easily increase the load on these UPS systems by consolidating servers or adding virtual hosts. A practical first step is to model the new control hardware load on existing UPS capacity, checking runtime for credible worst cases and verifying that breaker coordination and selectivity remain intact when UPS feeders are reconfigured.

On the field side, ABB System 800xAŌĆÖs integrated electrical control illustrates how tightly DCS and power protection can be coupled. When you migrate away from ABB or even to a newer ABB platform, you need a detailed mapping of all protective relays, trip coils, interlocks, and permissives that pass through the DCS. For each outgoing contact or digital output, identify whether it is advisory only, permissive, or trip-critical, then plan test procedures that prove those functions in the new platform. This is especially important for generator start sequences, automatic transfer schemes, bus-tie interlocks, and UPS or inverter bypass controls.

Inverter and drive systems, particularly large variable-frequency drives on critical motors, also depend on consistent control and protection interfaces. Disturbances here can force unexpected load changes on UPS systems feeding control or auxiliary loads. When you select a new DCS platform, consider how it handles high-speed trips, frequency and voltage monitoring from drives, and communication-based interlocks over fieldbuses or Ethernet-based protocols.

One often overlooked aspect is alarm and event rationalization. ABB, Honeywell, and other DCS vendors provide integrated alarm management tools. When using a replacement system, take the opportunity to rationalize and classify power-related alarms, such as UPS on battery, inverter overload, breaker failure, or relay misoperations. A modern DCS migration is a chance to tune alarm thresholds and priorities so that operators see the right information during disturbances instead of a flood of low-value events.

Technically, many modern DCS platforms can meet your process control and power-system needs. The harder question is which path gives you the best balance of risk, cost, and strategic fit. The following comparison summarizes where evolution within ABB or migration to an alternative tends to fit best, based on the patterns seen in ABB case studies, ARC guidance, RockwellŌĆÖs modernization experience, and integrator practices.

| Situation | Path That Usually Fits Better | Rationale |

|---|---|---|

| Large installed ABB base with many cabinets and deep electrical integration | Evolve within ABB (extensions, upgrades, SDe, Freelance, System 800xA evolution) | Conversion tools, I/O and wiring reuse, and incremental upgrades protect prior investment and reduce risk to protection and UPS interfaces |

| Mixed installed base with multiple small DCS and PLC islands, ABB not dominant | Evaluate alternative platforms such as Experion-based systems, Foxboro DCS, or modern open DCS | A consolidation strategy around a single non-ABB DCS may simplify training and spare parts more than retaining a minor ABB footprint |

| Strategic goal to adopt open, virtualized, cloud-aligned automation | Consider DCS suppliers with strong virtualization and open-architecture roadmaps as highlighted by ARC | Focus on suppliers whose DCS strategies align with containerization, modern orchestration, and flexible I/O for late binding |

| Severe obsolescence on an isolated ABB system with limited vendor support regionally | Either a targeted ABB modernization or a platform change, driven by service availability | If local ABB support is weak, an alternative with stronger regional presence can be more sustainable, even if migration is larger |

| Aggressive digital transformation program tied to a broader enterprise platform | Align DCS choice with the main digitalization ecosystem endorsed by corporate IT and OT | Rockwell and others emphasize that a modern DCS is central to digital transformation, so alignment with enterprise data and analytics platforms matters |

In practice, your decision will likely blend these categories. For example, you might follow ABBŌĆÖs incremental approach for a large base-load power station while standardizing future combined heat and power units on another vendorŌĆÖs DCS. What matters is that the strategy be deliberate, taking into account not just process control but the UPS, inverter, and power protection framework that ultimately keeps your plant safe.

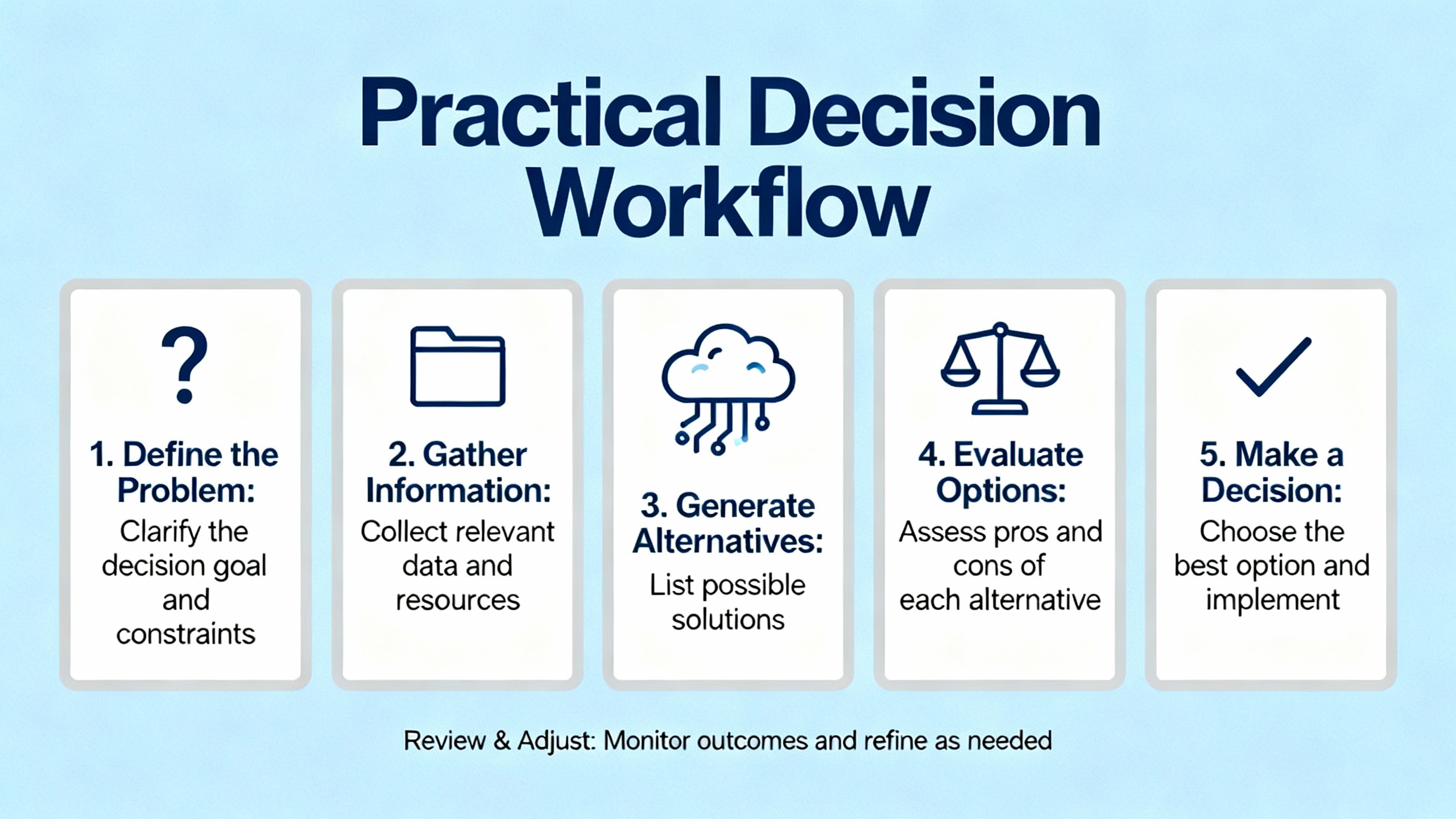

When advising owners, I find it helpful to work through a simple sequence of questions. First, clarify whether your process is primarily continuous and batch, or whether it is machine-centric and discrete. Multiple independent sources, including engineering articles and hands-on practitioner guides, agree that continuous and batch plants with high analog content lean toward DCS, while machine-dominated lines lean toward PLC architectures. If you are running a power plant, refinery unit, or large water treatment facility, a DCS remains the logical backbone.

Next, quantify your reliability and availability expectations. ABB and others routinely implement redundant controllers, networks, and I/O for high-availability applications. Foxboro DCS, PlantCruise, and modern Rockwell DCS offerings do the same. For UPS and power protection engineers, this is where you specify acceptable outage windows, failover behaviors, and how your DCS should behave during brownouts and transfer events.

Then, map integration requirements. ARC and Confluent highlight the growing importance of streaming operational data into business systems. If your corporate strategy leans heavily on a particular data platform, it can influence your DCS selection. ABB, Honeywell, Schneider Electric, and Rockwell all provide different integration paths into historians, analytics, and enterprise systems.

After that, look at lifecycle cost and resourcing. ABBŌĆÖs incremental upgrade strategy is designed to smooth annual spend and avoid the shock of a one-time replacement. HoneywellŌĆÖs and other vendorsŌĆÖ positioning of modular DCS solutions for mid-size plants similarly emphasizes predictable lifecycle cost. At the same time, remember that lifecycle cost is not just hardware and software. It includes the engineering hours needed to maintain interlocks, the availability of local support, and the difficulty of training new staff on the chosen system.

Finally, do not underestimate organizational readiness. ARC warns that adopting new automation technologies without changing work processes leaves legacy costs and inefficiencies in place. If your team is not ready to operate in a more virtualized, software-centric environment, or if your change management practices are weak, a conservative evolution of the existing ABB platform may be safer than a leap into a radically different architecture.

Q: How often should a plant plan major DCS upgrades?

ABBŌĆÖs lifecycle guidance suggests that DCSs can remain viable for the full plant life, often several decades, if they are evolved continuously through small, incremental upgrades. Industry commentary from Automation World and ABB emphasizes that waiting until a system is ŌĆ£no longer worth savingŌĆØ usually leads to higher risk and cost than following a steady, budgeted upgrade program that aligns with routine outages.

Q: Does moving away from ABB always mean more downtime than staying with ABB?

Not necessarily. RockwellŌĆÖs modernization discussions and ABBŌĆÖs own upgrade case studies both show that phased migrations, whether within ABB or between vendors, can be aligned with short planned outages and executed with minimal disruption. However, when moving to an alternative platform you typically face additional work in interface testing, I/O mapping, and protection logic verification, which increases project complexity even if outage windows are similar.

Q: Do I need to change my UPS and power protection scheme when I replace my ABB DCS?

In many cases you can retain existing UPS systems and protection schemes, but replacement projects almost always require detailed verification. New servers, virtual hosts, and networking equipment can change UPS loading, and any change to control hardware touching protective relays, breakers, or inverter controls demands functional testing. The safest path is to treat DCS migration and power protection review as a single integrated project, rather than assuming the electrical side is unaffected.

A well-planned ABB DCS replacement or evolution project is ultimately about protecting your plantŌĆÖs ability to ride through disturbances and restore normal operation quickly. If you keep that reliability lens in focus, and select upgrade or migration paths that respect both your process needs and your UPS, inverter, and protection constraints, you can modernize confidently while keeping risk under control.

Leave Your Comment