-

Please try to be as accurate as possible with your search.

-

We can quote you on 1000s of specialist parts, even if they are not listed on our website.

-

We can't find any results for ŌĆ£ŌĆØ.

As someone who spends a lot of time in substations, MCC rooms, and control rooms making sure UPS systems and process controls ride through bad power days, I have learned that the reliability of a Honeywell distributed control system (DCS) is not only about the controller platform. It is also about where your replacement I/O cards, communication modules, power supplies, and networking hardware come from. The wrong supplier can turn a minor trip into hours of downtime. The right supplier becomes part of your protection system, alongside your inverters, UPS, and surge protection.

This article walks through the key types of suppliers for Honeywell DCS components, the strengths and trade-offs of each, and practical criteria you can use to choose partners who actually improve plant reliability rather than just selling hardware.

A DCS is more than a set of controllers. According to guidance from ISA and industrial automation experts, distributed control systems are longŌĆæterm strategic investments that shape uptime, energy efficiency, and lifecycle cost for entire plants. Compared with PLCŌĆæonly architectures, DCS platforms are typically chosen when processes are complex, continuous, and expected to evolve, which is why they dominate in oil and gas, power generation, refining, and large chemical and pharmaceutical sites.

In the Honeywell ecosystem, Experion PKS and related platforms such as C300 controllers and PlantCruise are designed around robust, redundant architectures. Technical material summarized by Multisoft Systems describes Experion C300 as using Series 8 I/O, faultŌĆætolerant Ethernet networks, redundant controllers and power supplies, and modular control strategies, all aimed at high availability with strong safety integration. MarketsandMarkets notes that Honeywell delivers these systems through its Performance Materials and Technologies segment, with global operations in dozens of countries and a portfolio that extends from automation controls to safety systems and field instrumentation.

From a powerŌĆæsystems perspective, this means your Honeywell DCS is usually sitting at the center of generator controls, turbine and boiler logic, load shedding on mediumŌĆævoltage feeders, and sometimes gridŌĆætie interfaces. When a controller or I/O module fails, the impact is not just on process quality; it can directly affect protective schemes, UPS autonomy usage, and blackŌĆæstart readiness. That is why the choice of component suppliers is, in practice, a reliability decision.

Industrial Design Solutions describes modern DCSs as the backbone of process automation, and then immediately lists common problem areas: system integration challenges, communication failures, latency, data overload, security vulnerabilities, hardware failures, software bugs, operator errors, scalability limits, and weak vendor support. Only some of these problems can be solved by control logic or network design alone. Several trace directly to component quality and the behavior of your supply chain.

The article on highŌĆæquality DCS module suppliers at dcsmodule.com is very clear: control, I/O, and communication modules sit at the heart of the system, and failures can cause production downtime, safety risks, and substantial economic loss. From what I have seen in power and process plants, those failures often happen under the worst electrical conditions: brownouts, switching transients, or after a partial blackout when UPS batteries are low and inrush currents are high.

A supplier who ships untested, poorly stored, or counterfeit modules effectively becomes another source of random failure in your protection chain. In contrast, a supplier who performs full functional and aging tests, stores parts in antiŌĆæstatic, moistureŌĆæcontrolled environments, and stands behind traceable warranties reduces the chance that a corrective maintenance action will actually make your system less reliable.

The global DCS market itself is sizable. MarketsandMarkets projects growth from about $21.58 billion in 2025 to roughly $29.32 billion by 2030, with Honeywell listed among the major vendors alongside Siemens, Schneider Electric, Hitachi, and GE Vernova. Within that market, Honeywell not only sells complete Experion systems but also supports them with a wide ecosystem of channel partners and distributors.

For a plant engineer or reliability manager responsible for power supply and controls, the HoneywellŌĆærelated supplier landscape typically looks like several overlapping groups. There are Honeywell itself and its official channel partners, regional authorized distributors focused on measurement and control, solution providers who combine Honeywell hardware with engineering and lifecycle services, multiŌĆæbrand DCS module specialists that carry Honeywell alongside Siemens, ABB, and others, broad catalog resellers, and independent distributors who specialize in legacy or hardŌĆætoŌĆæfind parts. Each group plays a different role, and most large facilities eventually end up using more than one.

The table below summarizes these categories with representative examples drawn from the research and the types of applications where they tend to fit.

| Supplier type | Representative examples from research | Best suited scenarios | Key reliability benefits | Main watchŌĆæouts |

|---|---|---|---|---|

| Honeywell direct and official channels | Honeywell Process Solutions, Experion PKS offerings, global operations noted by MarketsandMarkets | New projects, major upgrades, safetyŌĆæcritical applications that require vendorŌĆæbacked designs | Full alignment with Honeywell roadmaps, strong training and lifecycle support | Higher upfront cost, longer lead times during demand spikes |

| Authorized measurement and control distributors | A. Hock as an authorized Honeywell distribution partner | Plants already standardized on Honeywell measurement/control, needing expansions and replacements | Assured authenticity, portfolio breadth, simpler procurement | May be focused on specific regions and product families |

| Solution and service providers | Relevant Industrial Solutions working with Honeywell | Facilities wanting installation, maintenance, and training bundled with hardware supply | Integrated support, remote assistance, tailored guidance | Quality depends on local engineering depth |

| MultiŌĆæbrand DCS module specialists | dcsmodule.com and Moore Automation Limited | Sites with mixed DCS brands including Honeywell, or needing rapid spare availability | Wide brand coverage, strong test and logistics processes | Must verify testing rigor and source transparency |

| Online catalogs and resellers | Cambia AutomationŌĆÖs Honeywell DCS collections | NonŌĆæurgent spares sourcing, price comparison, broad inventory browsing | Easy access to part numbers and rough availability | Limited technical guidance; documentation often resides elsewhere |

| Independent distributors for Honeywell parts | Vyrian as a sourcing guide for Honeywell components | Legacy systems, obsolete modules, or severe supply chain disruption | Access to hardŌĆætoŌĆæfind parts, flexible lead times, strong antiŌĆæcounterfeit programs when done right | Requires strict incoming inspection and qualification |

The rest of this article will look at these groups one by one and then tie them back to concrete selection criteria.

At the core of the ecosystem is Honeywell itself. MarketsandMarkets describes Honeywell International as offering its Experion DCS portfolio, including Experion Process Knowledge System, within the Performance Materials and Technologies business. The same analysis notes that Honeywell has operations in 77 countries and continues to invest in its DCS line, including a recent Experion PKS R530 release with virtualized environments and browserŌĆæbased remote access, as well as collaborations that integrate AI into refining processes.

Sourcing directly from Honeywell, or through its formally appointed channel partners, makes the most sense when you are implementing new systems, executing strategic migrations, or touching safety instrumented functions. You get hardware that is current with HoneywellŌĆÖs revision strategy, formal support for firmware and cybersecurity updates, and access to structured training for operators and maintenance teams. The article by Tao Shen via ISA emphasizes that a good DCS should combine proven yet innovative technology, high robustness, industryŌĆæspecific control functions, simplicity of configuration, and flexibility and scalability. Working through HoneywellŌĆÖs own channels gives you the best chance of seeing those qualities realized in a coherent, supported design.

From a reliability and powerŌĆæsystems viewpoint, this route is particularly important when your DCS is directly involved in generator controls, boiler protections, or grid interface logic. Any design or upgrade in those areas should be both technically sound and clearly defensible against standards and audits, which is much easier when the hardware tree and the engineering decisions are traceable back to the original manufacturerŌĆÖs specifications and guides. The tradeŌĆæoff is that official channels sometimes carry higher material costs and may not be optimized for emergency oneŌĆæoff module replacements.

A. Hock positions itself as an authorized distribution partner for Honeywell in measurement and control technology, and explicitly targets organizations that already operate Honeywell equipment and need new parts, replacements, or system expansions. The messaging is very clear: customers should be able to treat A. Hock as a oneŌĆæstop partner for essentially any product with a Honeywell logo.

For DCS owners, that model has practical advantages. In a typical substation or process unit, DCS I/O cards sit between central controllers and Honeywell transmitters, analyzers, switches, and safety devices. Having an authorized distributor who understands both sides reduces the risk of mismatched revisions, incompatible accessories, or missing configuration details. Since authorized partners receive products directly from Honeywell divisions, using them also lowers the risk of counterfeit or grayŌĆæmarket goods and simplifies warranty coordination.

ReliabilityŌĆæwise, an authorized distributor can help you standardize the control hardware around particular module families and power supply schemes, which in turn simplifies UPS sizing, spare stock planning, and panel design. The potential downside is that their scope is aligned tightly to HoneywellŌĆÖs catalog. If you have a mixed DCS population or heavy use of nonŌĆæHoneywell thirdŌĆæparty I/O, you may still need additional suppliers.

Relevant Industrial Solutions illustrates another important supplier category: partners who combine Honeywell hardware with comprehensive services. Their HoneywellŌĆæfocused page describes support that covers installation, maintenance, and daily operation with the explicit aim of ensuring longŌĆæterm performance and reliability. They also emphasize access to HoneywellŌĆÖs training programs and resources, dedicated specialists who tailor guidance to each facility, and remote assistance that reduces downtime.

In my experience, these partners are particularly valuable when you are integrating power systems and process controls across multiple sites, or when your inŌĆæhouse engineering team is stretched thin. The DCS selection guidance from Electric Neutron stresses that plants should evaluate not only technology but also the depth and quality of support services, including training, maintenance, troubleshooting, and a proven track record in similar industries. Solution providers like Relevant Industrial Solutions essentially become the local manifestation of that support.

For UPSŌĆæbacked control rooms, this can mean the difference between a messy, undocumented patchwork of control cabinets and a standardized, documented architecture where panel loads, redundancy levels, and bypass schemes are all known and coordinated. The risk is that quality can vary by region and by individual engineering teams, so you still need to vet these partners based on real project references and their ability to answer detailed technical questions about your Honeywell platform.

The dcsmodule.com article provides a detailed look at what highŌĆæquality DCS module suppliers should offer. It highlights that an excellent supplier covers mainstream DCS brands including Siemens, ABB, Honeywell, Emerson, Yokogawa, Foxboro, and Schneider Electric, with enough inventory depth across original equipment and compatible alternatives to support rapid delivery. For plants with mixed systems or longŌĆærunning upgrades, that sort of breadth is important.

Quality assurance is another pillar. The article calls for one hundred percent functional and aging tests, formal test reports or certifications such as CE and RoHS, and professional warehousing that controls static, moisture, and shock exposure. It also emphasizes the importance of a stable supply chain to avoid secondŌĆæhand or refurbished products being sold as new. From a powerŌĆæsystem reliability perspective, this is exactly where many plants get hurt. A module that has lived in an uncontrolled warehouse with temperature swings and condensation can fail as soon as it sees its first real load step or a disturbance on the DC bus.

Technical support completes the picture. dcsmodule.com notes that experienced suppliers should provide selection consultation, compatibility explanations, system upgrade suggestions, module debugging assistance, and remote or onŌĆæsite support. Moore Automation Limited, which publishes the dcsmodule.com blog, positions itself as such a specialist. When you are trying to keep a legacy Honeywell subsystem running while the rest of the plant increments towards a modern Experion architecture, having a supplier who can explain crossŌĆæcompatibility and propose realistic transition paths is as critical as the actual box they ship.

The same article points out that for emergency shutdown situations, delivery speed can matter more than price. That aligns with what many power plants quietly practice: it is often better to pay a premium for a tested card that arrives in a day than to save a few thousand dollars at the cost of extended outage and lost megawattŌĆæhours.

Cambia AutomationŌĆÖs Honeywell collection, as captured in the research, is an example of an online catalog that lists large numbers of Honeywell DCS, PLC, I/O, and industrial control products. It offers sorting by various criteria and functions mainly as a browsing and sourcing tool rather than a technical design resource.

The strength of such catalogs is that they make it easy to discover part numbers, rough stocking levels, and pricing ranges across a wide slice of hardware. For a plant reliability engineer managing both UPS inventories and DCS spares, catalogs can be useful to benchmark costs and see what is realistically available in the market before you finalize your stocking strategy.

The limitation is that catalog entries rarely give you the engineering depth you need. You still have to crossŌĆæcheck environmental ratings, power consumption, and redundancy capabilities against either Honeywell documentation or trusted technical partners. In other words, use these catalogs for what they are good atŌĆövisibility into the marketŌĆöbut do not confuse that with an engineering signŌĆæoff.

VyrianŌĆÖs guide to Honeywell authorized distributors and independent sourcing provides one of the most balanced treatments of independent distributors. It explains that authorized distributors work directly with Honeywell to sell genuine, active components with full traceability and manufacturer warranties, while independent distributors are not formally tied to Honeywell but specialize in obsolete, hardŌĆætoŌĆæfind, and legacy parts.

Vyrian argues that independent distributors add value by keeping older systems running without costly redesigns. They leverage global supplier networks to find discontinued Honeywell parts, often with shorter lead times and more pricing options. This is particularly relevant when you are supporting older Honeywell DCS generations or auxiliary controls that are still tied into your power protection schemes.

At the same time, Vyrian emphasizes quality assurance and counterfeit avoidance. They describe processes such as rigorous visual inspection, performance testing to verify parts against Honeywell specifications, and operating under standards like AS9120 and AS6081, which stress traceability and formal quality management. The recommended sourcing strategy is to rely on authorized distributors for current Honeywell technologies and use independent distributors for legacy and hardŌĆætoŌĆæfind parts, while enforcing strict incoming inspection for everything.

For powerŌĆæcritical plants, that strategy makes sense. You protect current production units and their UPSŌĆæbacked control systems with factoryŌĆæfresh modules, while using reputable independents to keep older substations and auxiliary plants running until you can justify a full modernization.

A discussion thread on Control.com, written by a former Honeywell engineer who later led a consulting firm, paints a candid picture of legacy Honeywell TDC/TPS systems. The author describes them as reliable but complex and expensive, built around proprietary architectures developed before commercial PCs were up to the task. He contrasts this with modern ITŌĆæserverŌĆæbased automation, which he claims can deliver better performance, richer functionality, and lower costs for new projects.

Regardless of whether you agree with every detail of that comparison, two points matter for sourcing decisions. First, legacy Honeywell systems often require specialized training and knowledge that are not widely available, which raises the stakes for supplier competence when you are buying replacement modules. Second, these systems will eventually sit beside or underneath more modern platforms, and you will need suppliers who understand both worlds well enough to avoid creating hidden single points of failure as you integrate or migrate.

This is where combining supplier types becomes pragmatic. You might rely on Honeywell and official partners for new Experion controllers, use a multiŌĆæbrand specialist to support legacy cards and interface modules, and bring in a solution partner to orchestrate the migration. Throughout, you would align these sourcing choices with your UPS architecture so that failover schemes and backup runtimes are sized for the combined, transitional system rather than a hypothetical end state.

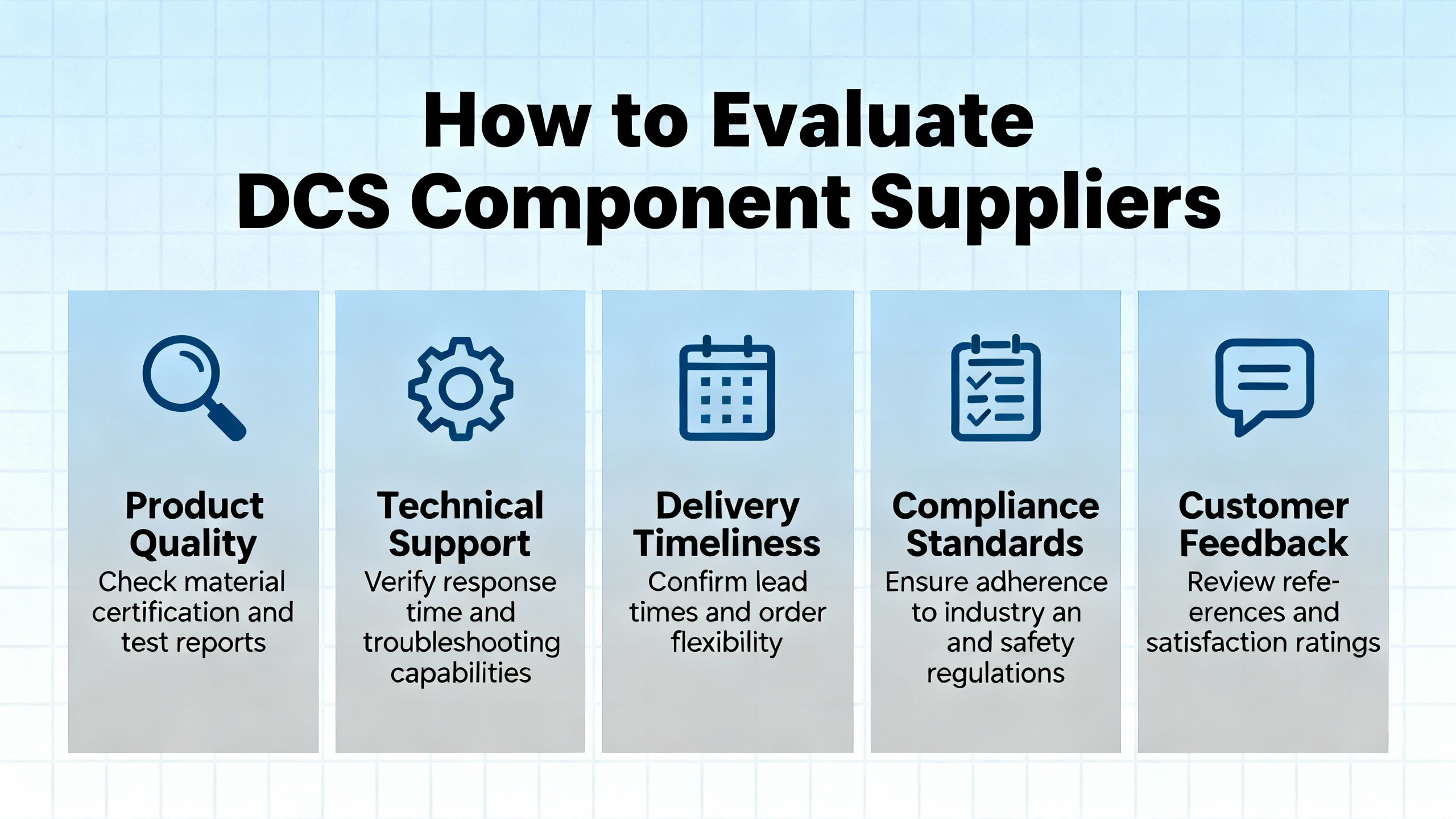

The article from dcsmodule.com suggests several characteristics of an excellent DCS module supplier, and they align well with what reliability engineering and DCS bestŌĆæpractice guides from ISA and Electric Neutron emphasize. Rather than treating these as a checklist to tick once, it is more useful to think of them as continuous evaluation criteria.

The first criterion is breadth and relevance of brand coverage. If your site runs Honeywell alongside Siemens, ABB, or Emerson, you will want suppliers who can serve that multiŌĆævendor reality. The dcsmodule.com guidance specifically highlights suppliers who can offer modules from major DCS brands and series, including both OEM and compatible alternatives. This does not mean you should mix and match indiscriminately, but it does mean your supplier should not be surprised by the heterogeneity of your cabinets.

The second is quality assurance. Look for suppliers who perform complete functional testing and, where appropriate, aging tests meant to reveal earlyŌĆælife failures. The article points to test reports and certifications such as CE and RoHS as basic evidence. From a reliability perspective, you should also ask about storage environments. A warehousing setup that protects modules from static discharge, moisture, and mechanical shock is not a luxury; it is part of the reliability chain just as much as the UPS that feeds your control power.

The third is technical and application support. The dcsmodule.com piece notes that strong suppliers provide selection consulting, compatibility explanations, system upgrade suggestions, module debugging help, and remote or onŌĆæsite support. This aligns with Electric NeutronŌĆÖs advice to evaluate vendors on their feature set, scalability, and especially their support services and track record in similar industries. In practical terms, a supplier that cannot answer detailed questions about firmware levels, redundancy configurations, or power supply requirements is not a supplier you should rely on for critical DCS gear.

The fourth is logistics performance. For plants where DCS modules protect large generation or critical manufacturing lines, delivery speed is more than a convenience. The dcsmodule.com article mentions large inventories, global delivery capabilities, familiarity with export documentation and HS codes, and multiple warehouse locations as hallmarks of strong suppliers. From a powerŌĆæsystems angle, this enables strategies like holding fewer onŌĆæsite spares for nonŌĆæcritical modules while relying on short lead times, and conversely stocking more onŌĆæsite spares for protectionŌĆæcritical modules where even a fast shipment would arrive too late.

The fifth is pricing structure and transparency. dcsmodule.com explains that module pricing usually spans original new, original used or refurbished, and thirdŌĆæparty compatible modules, each with different cost and risk profiles. For protectionŌĆæcritical applications tied to generator excitation, turbine trips, or primary breaker control, original new modules are usually the only responsible choice. For less critical functions, refurbished or compatible modules may offer acceptable risk at lower cost, provided the supplierŌĆÖs testing and warranty practices are solid.

Beyond these attributes, the same article explicitly recommends screening suppliers by reviewing their customer case studies and industry coverage, assessing their technical expertise through the speed and accuracy of their responses, requesting clear warranty plansŌĆöoften twelve to twentyŌĆæfour months with quick replacement during the warranty periodŌĆöand verifying product sources to avoid opaque channels. These are practical steps every reliability manager can take, and they are just as relevant to DCS components as they are to UPS systems or switchgear.

From a powerŌĆæsystems reliability standpoint, it is a mistake to treat DCS components, UPS systems, and power distribution as separate domains. The GE IS420PUAAH1A I/O module, discussed by Moore PLC, illustrates the sorts of specifications you should be looking at when you evaluate any module sitting behind your UPS: response times in the millisecond range, environmental ratings down to very low temperatures and up to high operating temperatures, humidity tolerance up to nearly saturated air, defined input power requirements and power consumption, and certifications like CE, UL, and RoHS. Those details drive both how the module survives electrical disturbances and how you size and protect its DC supply.

When you choose suppliers for Honeywell DCS components, include your UPS and power quality requirements in the conversation. Suppliers should be able to provide accurate data on power consumption and inrush behavior so that your UPS capacity and inverter ratings are adequate. They should also understand, at least at a basic level, how redundant DC feeds, dual power supplies in controllers, and selfŌĆæhealing networks interact with your power architecture.

Practically, this means grouping critical DCS cabinets on highŌĆæavailability UPS outputs, ensuring that replacement modules are qualified for the environmental conditions in those rooms, and verifying that surge protection and grounding schemes remain valid after any module changes. It also means planning spare stocks in a way that reflects both power and control criticality: you may accept longer lead times for modules that only affect nonŌĆæcritical monitoring, but not for those that participate in load shedding or fast generator protection.

Authorized distributors work directly with Honeywell and provide current, genuine parts with manufacturer warranties and direct technical support. They are usually the best choice for active product lines, safetyŌĆærelated modules, and major upgrades. Independent distributors, as described by Vyrian, add value when you need obsolete or hardŌĆætoŌĆæfind parts for legacy Honeywell systems. The most capable independents operate under recognized quality standards, use rigorous inspection and testing, and maintain strong traceability practices. A balanced strategy is to favor authorized channels for new systems and critical protection roles, while using qualified independents for legacy support under strict incoming inspection.

The dcsmodule.com guidance outlines three pricing tiers: original new, original used or refurbished, and thirdŌĆæparty compatible modules. For functions that directly affect plant safety or critical power protection, original new modules are the safest option because their history and performance should align with the original Honeywell specifications and warranties. Refurbished and compatible modules can make economic sense for nonŌĆæcritical applications, especially when the original parts are discontinued, but only if the supplierŌĆÖs testing, certification, and warranty practices are robust and transparent. It is essential to align these choices with your plantŌĆÖs risk tolerance and the role that each module plays in the control and protection hierarchy.

There is no single number that fits every facility, but a practical approach is to identify which modules have the highest impact on power and safetyŌĆösuch as critical controllers, communication modules used in protection schemes, and power supplies feeding themŌĆöand ensure you have at least one tested spare for each of those on site. For lowerŌĆæimpact modules, you can rely more heavily on suppliers with proven rapid delivery, especially if they maintain large inventories and multiple warehouses, as dcsmodule.com recommends. The key is to design your spare strategy together with suppliers you trust, based on real lead times, failure histories, and the consequences of losing specific functions.

In industrial and commercial power systems, your Honeywell DCS and your UPS and inverter fleet share the same mission: keep critical processes safe and running, even when the grid does not cooperate. Choosing the right mix of HoneywellŌĆæaligned suppliers, multiŌĆæbrand specialists, and carefully vetted independent distributors turns your component supply chain into another layer of protection rather than a hidden vulnerability.

Leave Your Comment